- REITs=investment vehicle that invests in rent-yielding,complete real estate properties.

- helps attract long-term financing and improve find availability to real estate developers.

- SEBI introduced REMFs by AMFI committee recommendations with draft regulations in 2008.

- Post the clarification provided in the budget, SEBI on 26th September 2014 finally notified the final regulations-SEBI (Real Estate Investment Trust) Regulations, 2014.

- IPO of 1st REIT Embassy Officer Parks raised INR 47.5 billion in 2019

- owned by blackstone LP and bengaluru based developer embassy property developments pvt.ltd.

- 7 office parks/4 office buildings

- The share price shot up 34% in 1st 6 months

- india-31st country to enact REIT legislation.

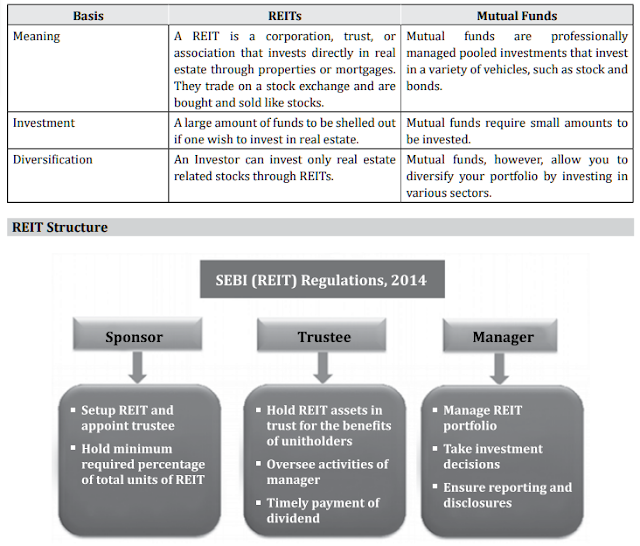

SEBI(REIT) REGULATIONS,2014

- trusts set up under Indian Trusts Act,1882

- each sponsor shall hold 5% min. units on a post-initial offer basis and collectively hold min. 25% for 3/more years from listing.

- trustees registered under SEBI (debenture trustee) regulations, 1993 and not associates of sponsors/managers

- mandatory listing

- at least 80% asset value invested in complete & revenue-generating properties.

- remaining 20%:

- Developmental properties

- Listed or unlisted debt of companies/body corporate in real estate sector

- Mortgage backed securities

- Equity shares of companies listed on a recognized stock exchange in India which derive not less than 75% of their operating income from Real Estate activity as per the audited accounts of previous financial year

- Government securities

- Unutilized FSI of a project

- TDR acquired for the purpose of Utilization

- Money market instruments or Cash equivalents

- NAV declared within 15 days of valuation/updation

- at least 90% of Net Distributable Income after Tax distributed as dividend to unitholders at least on half-yearly basis within 15 days.

- investment directly/through Special Purpose Vehicles (SPVs) of which REIT would have controlling interest.

- min. offer size= INR 250 crores

- min. subscription=10,000/15,000

- shall not offer less than 25% units on a post-issue basis to the public in IPO subject to conditions.

- aggregate consolidated borrowings & deferred payments shall never exceed 49% of asset value

- if such exceed 25%, approval from unitholder and credit rating required.

- asset value=at least INR 500 crores

- min. unitholders other than sponsors/related parties and associates in public=at least 200.

ELIGIBILITY CRITERIA

- registered with SEBI

- APPLICANT:must be sponsor or on behalf of trust deed

- SPONSOR

- hold 5%/more and be clearly identified in registration application

- for each sponsor group,1 identified as sponsor

- collective net worth (NW) of INR 100 cr./more and individual NW of 20 cr./more

- sponsor/associate have 5 years/more experience in real estate development/fund mgmt.

- if sponsor is a developer, at least 2 projects have been completed

- MANAGER

- if body corporate,NW=10 cr./more;if LLP,value of Net Tangible Assets=10 cr./more

- 5 years experience in fund mgmt/advisory services/property mgmt & at least 2 KMPs each having 5 yrs. experience.

- half/more directors or members of the governing board=independent and not be directors/members of another REIT.

- must've entered into investment mgmt agreements with trustee

- TRUSTEE

- registered under SEBI regulations

- not an associate of sponsors and have experience as required

- unitholders enjoy equal voting rights and no multiple classes but sponsors and associates may be issued inferior voting rights units.

- applicant describes proposed activities

- whether any previous app rejected or any disciplinary action taken under any act.

ISSUE AND ALLOTMENT OF UNITS

- only an IPO and no offer unless

- registered with SEBI

- assets owned in the specified portion of underlying assets/SPVs=500 cr./more

- max. subscription from investors other than sponsors shall be <25% total unit capital within 3 years of listing.

- or 75% unitholders approve except related parties

- if no approval,exit option given

- offer size=250 cr./more

- asset ownership/REIT size=500cr./< complied anytime before allotment with adequate declaration/disclosures.

- units offered:

- if Post Issue Cap (PIC) @ offer price<1600 cr; 25%/more of total o/s units

- if PIC 4000>x>/=1600 cr; 400 cr.

- if PIC =/>4000 cr; 10% of total o/s units and units offered in offer doc

- units offered to manager/sponsor not counted

- subsequent issue by follow-on offer,preferential allotment,QIP,rights/bonus issue,offer for sale

- through the merchant banker, file offer doc along with prescribed fee with stock exchange & SEBI

- draft OD filed with SEBI made public for 21 days/more

- draft/final OD accompanied by due diligence certificate by lead merchant banker

- SEBI may communicate comments/modification

- lead merchant bankers take them into account

- SEBI can do so within 21 days

- file with exchange and SEBI not less than 5 working days before opening

- IPO/FPO within 1 year of observations otherwise a fresh draft OD

- foreign investors compliant with RBI and indian govt.

- subscription app accompanied by a statement containing an abridged version of OD,detailing risk factors & summary.

- min. subscription accepted between 10,000-15,000

- open for subscription for upto 30 days

- over subscribed allotted proportionately within 12 working days from closing.

- issue units only in dematerialized form

- price determined through book building process

- refund if:

- fails to collect 90% subscription

- extent of over subscription and if retained not utilised generally

- if subscribers<200

- interest @ 15 p.a.if 21. not complied

- units may be offered for sale if:

- held for at least 1 year (measured from being fully paid-up) prior to filing OD

- subject to other SEBI guidelines

- general purposes mentioned in OD shall not exceed 10% of the raised amount.

- if IPO is not within 3+1 years of registration;surrender registration certificate and cease operations and later apply for re-registration.

- any other SEBI guidelines/circulars

UNITS LISTING/TRADING

- after IPO,mandatory listing within 12 days from closing

- a/c to listing agreement

- if non-receipt of listing permit,liable to refund subscription+interest @ 15%

- traded,cleared and settled a/c to bye-laws of stock exchange

- trading lot=1 unit

- redemption=buy-back/delisting

- remain listed unless delisted

- minimum public holding rectified within 6 months by manager failing which, apply for delisting

DELISTING

- apply if:

- public holding falls below the limit,i.e 200

- no projects/assets exceeding 6 months and doesn't propose investing in the future;maybe extended by 6 months with unitholders' approval.

- violation of listing agreement

- sponsor/trustee requests with unitholders' approval

- unitholders apply

- in the interest of unitholders

- SEBI considers for approval/rejection

- instead of delisting, may provide additional time to comply

- reject and take another action

- provision of exit option

- windup & sell assets to redeem units

- after delisting,surrender the registration certificate and continue to be liable notwithstanding such surrender.

INVESTMENT CONDITIONS AND DISTRIBUTION POLICY

- shall not invest in vacant/agricultural land/mortgages other than mortgage-backed securities;inapplicable to incomplete projects.

- may invest in properties through SPVs:

- no other shareholder/partner shall exercise rights that prevent compliance

- manager consulting with trustee shall appoint nominees/board majority proportionate to SPV interest

- The manager ensures REIT's vote is counted in each SPV meeting.

- appropriate resolution mechanism and prevailing REIT regulations

- invest in properties through holding co.:

- The ultimate holding interest is 26%/more

- no other shareholder or partner of the holdco or the SPV(s) shall exercise any rights that prevent the REIT, the holdco or the SPV(s) from complying with the provisions of REIT Regulations and an agreement has been entered into with such shareholders or partners to that effect prior to investment in the holdco and/or SPVs.

- proportionate majority/nominees

- REIT's vote counted

- 80%/more asset value invested in completed/rent OR income generating properties:

- only direct investments considered

- project implemented in stages;only the part completed/revenuable considered

- <20% invested in other than 5. and in:

- properties

- under-construction properties held for 3/more years after completion

- under-construction part of existing income/rent generating held for 3/more years

- debt in real estate

- not include debt in holding co/SPV

- mortgage backed securities

- listed equity deriving 75%/more operating income from real estate

- unlisted equity deriving 75%/more and investing per 1.

- govt. securities

- unutilized FSI in which already invested

- TDR in an already invested project

- money market instruments/cash equivalents

- investment conditions compliant @ offer doc and thereafter

- 51%/more consolidated revenue and other gains from property disposal incidental to leasing

- monitored half-yearly & at asset acquisition;if breached manager tells trustee and ensures satisfaction within 6+6 months of breach

- hold completed/rent generating properties for 3/more years

- sale exceeding 10% asset value,managers shall obtain unitholders' approval

- manager shall consider the remaining term of the lease, the objectives of the REIT, the lease profile of the REIT’s existing real estate assets and any other factors as may be relevant, prior to making such investment.

- co-investment:

- equally favourable for other parties and REIT

- investment shall not provide rights preventing REIT from compliance

- agreement includes min. % of distributable/REIT entitlement to receive not less than pro rata distributions.

- distributions:

- 90%/more of net distributable cash flows distributed proportionately:

- cash flows from underlying SPVS distributed 100% to REITS

- cash flows by holdco 90%/more to REIT

- 90%/more of net distributable cash flows to unitholders:

- declaration not less than once every 6 months and made not later than 15 days of declaration

- interest @ 15% p.a

- if property/equity/interest sold:

- proposes to reinvest sale proceeds

- if not invested within a year ,distribute 90%/more

- no schemes launched under REIT

- SEBI specifies additional conditions

UNITHOLDERS' RIGHTS/MEETINGS

- right to receive income/distribution as provided

- 25%/more valued unitholders apply to the trustee in writing for:

- manager places an issue in voting

- 60%/more apply in case of exit option

- any matter requiring approval:

- votes exceed a certain %

- postal ballot/electronic mode

- notice of not less than 21 days

- related party voting not considered

- manager/trustee responsible for conducting meetings

- annual meeting not less than once a year within 120 days from FY end

- info required to be disclosed in ordinary course may require approval taken up

- votes in favour>votes against or votes favourable not less than one and a half times of votes against

- change in sponsor:

- 75% approval except related parties

- if not required approval:

- proposed sponsor to provide exit option

- same if change in control of sponsor

DISCLOSURES

- OD according to schedule II of REIT regulations.

- manager to submit annual report to unitholders within 3 months from FY end.

- half-yearly report within 45 days of from 30/9 containing disclosures as required

- manager to submit info to exchanges and unitholders periodically

LIABILITY FOR ACTION IN DEFAULT under SEBI (intermediaries) regulations,2008

strategic investors to investors in REIT vide SEBI circular 18/01/2018 5%/more of total offer size or amt. as prescribed by SEBI

SEBI may exempt not exceeding twelve months, for furthering innovation

in technological aspects relating to testing new products, processes, services, business models, etc. in the live environment of regulatory sandboxes in the securities markets.

“Regulatory Sandbox” means a live testing environment where new products, processes, services, business models,

etc. may be deployed on a limited set of eligible customers for a specified period of time, for furthering innovation in

the securities market, subject to such conditions as may be specified by the SEBI.

No comments:

Post a Comment