OPPRESSION & MISMANAGEMENT UNDER CO. ACT, 2013 (Ch XVI)

Sec. 241-246: oppressive/biased affairs against minority shareholders or any other member.

"OPPRESSION","MISMANAGEMENT" NOT DEFINED IN ACT.

REGULATORY FRAMEWORK

IMP. CASE LAWS

- Shanti Prasad Jain v. Kalinga Tubes Ltd. (1965)

- Rajahmundry Electric Supply Corp. v. A. Nageswara Rao (1956)

- SINGLE ACT TREATMENT:Maharashtra Power Dev. Corp. v. Dabhol Power Co. (2004)

- NON-DECLARATION OF DIVIDEND:Mr. Vasudev P Hanji & Others v. Ashok Ironworks Pvt. Ltd. (2008, 145 Comp. Cases 717), and in the case of Jaladhar Chakraborty & Ors. v. Power Tools and Appliances Co. Ltd. (1994)

- INCREASE OF SHARE CAP FOR OLE PURPOSE OF GAINING CONTROL=OPPRESSION:Dale and Carrington Investment (P) Ltd. v. P. K. Prathapan and Others [(2004) Vol. 122 CC 161]

APP TO TRIBUNAL FOR RELIEF

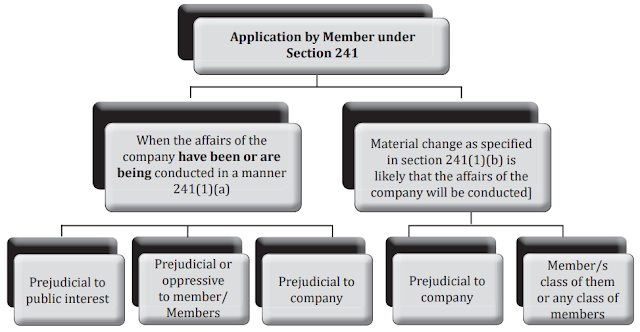

- App By MEMBER (241[1])

- any member having such rights under (244) complaining of prejudice

- App by CG (241[2]): if being of opinion that affairs are handled prejudicially to public interest.

- Initiating and Referring Cases to NCLT (241[3]):

- person connected to fraud, malpractice, malfeasance and negligence

- business not conducted/managed up to standards

- co. conducted/managed by a person likely to cause injury/damage to co.

- CG may request the tribunal to inquire about the case related to conduct/mgmt. of co.

- Signing/Verification of app (241[5])

- concise statement for inquiry purposes

- acc. to CPC,1908

- RIGHT OF MEMBERS TO APPLY (244)

- provided tribunal may waive off these requirements

- member, but not a shareholder

- beneficial owner = member

- If the company has made few calls and not yet made the remaining calls to make those shares fully paid, in those circumstances also the members holding those partly paid shares are eligible as per the criteria mentioned in this Section. But in case if the company has made calls for making the shares fully paid up and few members have not paid such calls, then members w.r.t. such party-paid shares shall not be eligible.

- preference shareholders = members

- debentureholders not members

TRIBUNAL'S DISCRETIONARY POWER W.R.T. WAIVER APPS: Cyrus Investments Pvt. Ltd. & Anr. v. Tata Sons Ltd. & Ors: Case Study

POWERS OF TRIBUNAL

- (242[1]) tribunal makes a fitting order if satisfied:

- co. conducted in an oppressive/prejudicial manner

- winding up would unfairly prejudice in this case

- (242[2]) order providing:

- future conduct regulation

- share/interest purchased amongst members

- following buy-back, subsequent reduction

- transfer/allotment restriction

- termination,setting aside or modifying agreements b/w co. & key managerial personnel (KMPs) or others

- setting aside acts related to property within 3 months before application be deemed fraudulent

- removal and subsequent allotment of MDs,directors or managers

- recovery of undue gains by KMPs and their utilisation

- tribunal nominated directors

- cost imposition

- any other just and equitable provision

- (242[3]) certified order copy filed with registrar within 30 days of order

- (242[4]) may make an interim order to suffice

- [4A] fitness of respondent to hold office

- (242[5,6]) alterations made with the same effect as if made by co. under the same provisions

- [7] filed with registrar within 30 days

- [8] co. fined 1-25 lakhs and officer(s) 25,000 to 1 lakh

- (243) terminate,set aside, modify agreement under (242)

- shall not give rise to claims against co.

- whose agreement is modified shall not hold the same designation for 5 years

- [1A] CG may reduce this time

- [1B] no compensation to the removed

- [2] conniving KMP fined 5 lakhs

TRANSFER/TRANSMISSION (56,72)

- conditions (56[1])

- not recorded unless both beneficiaries unless proper instrument delivered within 60 days from execution

- [2] co. can still register based on the board's indemnity.

- [3] app by transferor for partly paid shares notified to transferee for objecting within 2 weeks of notice receipt

- [4]subscribers to memorandum: 2 months from incorporation, 2 months from date of allotment, 1 month for transfer/transmission, 6 months from allotment of debenture

- [5] transfer by legal representative as if made by actual holder

- [6] co./officer fined 50,000 for contravention

- (72) transferred to nominee in case of death

- (57) impersonation of shareholders: imprisoned 1-3 years/fined 1-5 lakhs

- (58) registration refusal and appeal against refusal

- [1] pvt. co. = per AoA and send notice within 30 days to applicant

- [2] public co. = freely transferable but transfer agreement enforceable as contract

- [3] appeal to the tribunal within 30 days of refusal notice or no response from co. within 60 days of submission

- [4]public co. = appeal within 60 days of refusal or 90 days of submission

- [5] tribunal orders as necessary and co. complies within 10 days of order receipt

- violation of [5] not compoundable otherwise, as per (57)

- (59) rectification of members registers by member/aggrieved person or co.

- SUFFICIENT CAUSE

- Benarsi Das Saraf v. Dalmia Dadri Cement Ltd. AIR 1959 Punj. 232

- Indian Chemical Products Ltd. v. State of Orissa AIR 1967 SC 253

- Smt. Mallina Bharathi Rao v. Gowthami Solvent Oils Ltd [2001] 31 SCL 60 (CLB – CHENNAI)

- Asha Purandare v. Integrated Controls (P.) Ltd. [2002] 39 SCL 970 (CLB – MUM.)

- Gulshan Mahindru v. Reliance Industries Ltd. [2014] 47 taxmann.com 186 (CLB - Mumbai)

- [2] tribunal orders as necessary and may impose damages

- [3] no restriction on voting rights unless suspended by tribunal

- [4] transfer contravening law = app by depository,depository participants,co;holders or SEBI

(452) PUNISHMENT FOR WRONGFUL WITHHOLDING PROPERTY

- If any officer/employee

- wrongfully obtains possession

- wrongfully withholds or wrongfully applies to unexpressed purposes

- fined 1-5 lakhs

- ordered to refund benefits or imprisoned for 2 years unless the court satisfied that payment doesn't relate to:

- PF,gratuity fund or welfare fund

- compensation/liability owed to workmen's death or disablement

No comments:

Post a Comment