2.1

- circulation of Unpublished Price Sensitive Info (UPSI) about certain co.

- SEBI ordered a 15 lakhs penalty on each appellant for violating Sections 12 A (d) & 12 A (e) of the SEBI Act, 1992 and Regulation 3 (1) of SEBI (Prohibition of Insider Trading [PIT]) Regulations, 2015

- hence,applicants appealed to the SAT

- SEBI orders reflect numerous messages on quarterly results closely matching with actual statistics which were finalized within 15 days of quarter closure and disclosed on stock exchanges 15 days after finalization.

- Thus, the deviation between the figures given in the WhatsApp message and actual result was 0.47% regarding revenue, 0.03% in the case of PBIT and 0.03% in the case of PBT. A similar pattern was observed regarding the other WhatsApp messages.

- SEBI reasoned that as employees, their duties didn't involve sending any such messages.

- proximity of circulation to publication and resemblance among figures weighed with AO

- each appellant contended that none of them were originators of the message but simply forwarders

- SAT's order set aside SEBI's penalty and said AO failed to:

- appreciate that appellants pleaded that they weren't originators and messages were floated in the public domain

- consider other similar messages not matching published financial results like with axis bank's result pointed out by shruti vohra.

- prove probability preponderance that this was UPSI with the knowledge of appellants.

2.2

- appeal preferred by aggrieved due to AO's order dated 12/09/2019

- imposing 5 lakhs penalty

- for violating Clause 36 of the Equity Listing Agreement read with Section 21 of the Securities Contracts (Regulation) Act, 1956 and Regulation 12(2) of the SEBI (Prohibition of Insider Trading) Regulations, 1992.

- question=whether info of a binding implementation agreement on 18/05/2010 with dominant shareholders be disclosed immediately.

- SAT's view-penalty order(2019) against appellant prejudicial as suffers from laches(delay) and charge=delay of 1 trading day in disclosures but delay on SEBI for issuing show cause notice=2955 days from event & 2130 days from prelim. investigation report.

- laches alone won't vitiate but penalty of 10 lakhs can't be sustained and should be lessened while upholding order on merits

- appeal partly allowed as penalty reduced to a mere warning

2.3

- AO imposed 25 lakhs penalty for violating Code of Conduct to the Securities and Exchange Board of India (Credit Rating Agencies) Regulations, 1999 while granting credit rating to IL&FS for FY 2018-19

- The second Show Cause notice issued by SEBI 28/01/2020 for why shouldn't be enhanced as considered penalty not in market interest.

- Section 15-I(3), the SEBI can call for and examine records of proceedings if it considers the orders passed by the adjudicating officer erroneous and not in the interests of securities markets. After examining the matter, the SEBI can enhance the quantum of penalty imposed.”

- appeal filed for proceeding under second SC notice to be stayed disposed by SAT

- SAT directed appellant to deposit 25 lakhs within 4 weeks subject to appeal result

- proceedings shall continue along with giving opportunity of hearing to appellant but order not affected during this appeal pendency.

2.4

- present appeal filed against ex-parte order 15/06/2020 issued by SEBI's WTD directing appellant to deposit 2,66,59,215+int.=3,83,16,231in an Escrow Account towards notional loss allegedly avoided by him by using unpublished price sensitive information and further directed that the bank accounts / demat accounts of the appellant shall remain frozen till such time the amount is not deposited. The WTM further directed the appellant to show cause as to why an order of disgorgement should not be passed.

- appellant is CEO/MD of co. engaged in mft. aerospace,automobile and engineered products.

- charge=allegedly sold 51,000 shares having inside knowledge after which prices drastically went down thus making notional gain/averting notional loss.

- SAT finds no extreme urgency for passing an ex-parte order without considering convenience balance/irreparable injury.

- impugned order can't be sustained and quashed at admission without calling a counter affidavit except SC notice

- APPEAL=ALLOWED

2.5

- appellant co. mobilized finds through issuance of redeemable preference shares (RPS) during 2010-11 to 2013-14.

- collected 33,39,86,230 from 32,454 investors during 4 years

- appeal filed challenging AO's 1,00,00,000 penalty under Section 15HB of SEBI Act for violation of Regulations 4(2) and 16 of SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) regulations 2013

- investor>49 in each 4 years;tantamount to a deemed public issue without following procedure for public issue/listing

- upholding impugned order,SAT reduced penalty to 50 lakhs to SEBI within 4 weeks from order.

- if failure to deposit,interest @ 12% from date of impugned order.

- appeal partly allowed and disposed with no order as to costs

2.6

- The stock exchange surrendered respondent's recognition due to non-fulfillment of SEBI criteria and shares placed in NSE's dissemination board w.e.f. 01/12/2014.

- The next day,a circular was issued by co. to shareholders for availing buying/selling of shares

- appellant=shareholder aggrieved by order of NSE for removal of co. from board

- SAT finds co. permitted to provide an exit option and don't find any illegality in removal.

- appeal fails and is dismissed

2.7

- The respondent ordered compulsory delisting (26/06/2018)

- appellant only aggrieved by fair value computation @ 9.07/equity share filed appeal for details under Section 23L of the Securities Contracts (Regulation) Act, 1956.

- There is a delay of 73 days in filing the appeal.

- reason=regstd. office @ ahmedabad and took some time to find a specialized lawyer & cumulating various documents along with financial difficulties.

- contended that since no information was supplied the present appeal was filed along with an application for condoning the delay.

- sufficient cause=explained and adequate/satisfactory per SAT

- delay in filing appeal=condoned

2.8

- appellant engaged in acquiring agricultural land/developing for re-sale.

- SEBI found that fund mobilization fell within "collective investment schemes" as under Section 11AA of Securities and Exchange Board of India Act, 1992 (hereinafter referred to as, ‘SEBI Act’).

- SEBI issued an order dated November 9, 2015 under Section 19 read with Sections 11(1), 11B and 11(4) of the SEBI Act read with Regulation 65 of Securities and Exchange Board of India (Collective Investment Schemes) Regulations, 1999 issuing a slew of directions restraining the appellant and its directors from collecting any money from the investors or to launch or to carry out any investments schemes.

- further directed to refund money collected.

- appellants being aggrieved filed an appeal being willing/ready to comply and contending that 27.48 cr out of 31.71 has already been refunded.

- SAT finds no proof of refund; in absence of evidence,SAT finds no infirmity in order.

- appeal lacks merit and is dismissed

2.9

- acquirers failed to make an Open Offer beyond threshold per Regulation 10 and 11(1) of SAST Regulations, 1997, on, April 1, 2007 and September 14, 2007, respectively. As per Regulation 21(19) of SAST Regulations, 1997, the acquirer and the PAC’s were jointly and severally liable for discharge of obligations under SAST Regulations

- The open offer remains unaffected even after 2011 regulations repealed the 1997 ones.

- obligations still enforceable by regulation 35

- SEBI directed acquirers/PACs to make Public Announcement (PA) of a combined offer within 45 days of order coming into force.

- offer price+interest @ 10%p.a. for delay starting from liability incurred date till payment of consideration

2.10

- noticee traded(14/08/2014 to 17/11/2015) through FDSL in scrip of RIcoh India Ltd. (ricoh) while having UPSI

- wrongful gain of 1,13,56,118 in FDSL a/c and avoided a loss of Rs.1,16,77,892/- in the account of FDSL.

- The noticee is the Managing Director and Promoter, having shareholding/control of 73.23% in FDSL by

- improper conduct of insider trading

- the fraud of manipulation of accounts of Ricoh with the involvement of FDSL and its Managing Director i.e, the noticee

- being the ultimate beneficiary as controlling promoter and dominant shareholder of FDSL.

- so the FDSL corporate veil requires to be lifted and noticee liable for insider trading along with for an amount of INR2,30,34,010/-and interest

- SEBI directed FDSL MD (noticee) DISGORGE 2,30,34,010 +12% interest within 45 days and restrained from securities market for 7 years.

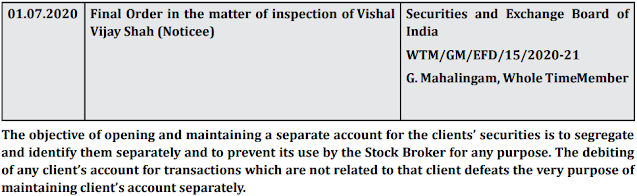

2.11

- noticee = regstd. stock broker received funds in the client and settlement A/C from third parties in cash and paid on behalf of clients along with making withdrawals.

- under SEBI circulars,responsible for receiving payments directly from clients

- should have taken expedient steps to exceptionally deal with funds and suitable explanations should have been asked from the client and nothing on record suggesting so.

- admitted to carrying out such irregular practices and conduct demonstrates failure to maintain fairness and exercise due skill

- BSE had earlier conducted inspection of the Noticee and upon a consideration of the BSE Inspection Reports in light of the Inspection Report, it is observed that the violations committed by the Noticee in the instant proceedings are repetitive in nature. Further, it is a well settled position of law that SEBI may initiate multiple proceedings for the same set of violations.

- The Noticee had violated the aforementioned provisions of the Stock Brokers Regulations and aforementioned SEBI Circulars. Having regard to the facts and circumstances of the instant proceedings

- SEBI accepts the recommendation of the Designated Authority that the Certificate of Registration of the Noticee be suspended for a period of one year.

2.12

- noticee employed fraudulent arrangement by entering pledge agreement for GDR subscription detrimental to investor's interest

- deliberately making false/misleading statements, misrepresenting, actively suppressing and concealing material facts /regarding GDR proceeds being available at Beckon’s disposal when in fact GDR issuance, was just a facade to create underlying equity shares without receipt of consideration.

- evident that GDR served as collateral taken by vintage in subscribing GDR transferred to transferee when vintage repaid the loan to EURAM

- established that Beckons deliberately and actively concealed true/material facts warranting no leniency

- the manner in which the entire scheme of fraudulent and deceptive scheme was planned and executed demonstrates beyond reasonable doubt the manipulative intent to deliberately withhold the critical information to Stock Exchange and also to the investors which ultimately enabled them to carry out the fraud. Such a conduct by a listed company erodes the trust and confidence of investors and also threatens the integrity of the securities market. Therefore, such lapses need to be dealt with sternly to protect the interest of investors in the securities market.

- SEBI imposed suitable penalty of 10 cr. on beckons under 15 HA of SEBI act alleging fraudulent GDR issue by way of credit arrangement not disclosed to stock exchange.

- also made misleading disclosure to the stock exchanges that “it had successfully closed its Global Depository Receipts issue..” and thereby violated the provisions of section 12A (a),(b) and (c) of SEBI Act read with Regulation 3 (a) (b) (c) (d), 4 (1), 4 (2) (f) (k) (r) of SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003.

- noticee 1/2 employed fraudulent arrangement as stated before and actively played a role in defrauding indian investors.

- alleged that Noticees violated the provisions of section 12A (a), (b) and (c) of Securities and Exchange Board of India Act, 1992 read with regulations 3(a), (b), (c), (d) and 4(1) of SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003

- SEBI imposed 1 cr./20 lakhs as penalty on noticee 1/2 respectively as directors of Beckons

2.14

- noticee indulged in execution of alleged non genuine trades such as 530 unique contracts in stock options out of which 528 were ingenuine and 1151 out of 1154 trades are ingenuine

- resulting in artificial volume of 2,87,13,000 units in given 528 contracts

- registered a /+ve close out difference = 8,06,09,700

- trades reversed on the same day and within a few minutes with the same counterparty at substantial price difference without basis for significant change indicating artificialness/ingenuity.

- SEBI imposed 84 lakhs penalty on noticee under 15HA for market abuse/fraudulent practices resulting from artificial trades of 1% to 100% out of 528 contracts creating misleading appearance in scrip.

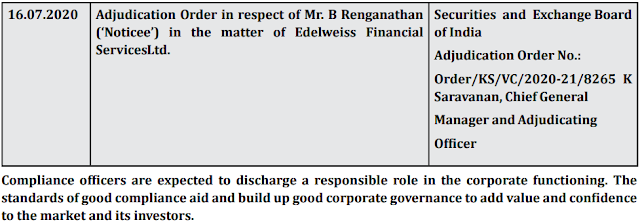

2.15

- upon receipt of report from NSE,SEBI conducted investigations in dealings of EFSL to examine violations.

- noticee = compliance officer/CS

- ECAP,a subsidiary of EFSL acquired AIMIN on 05/04/2017 following a term sheet on 25/01/2017

- acquisition deemed a UPSI

- Despite that,the noticee failed to close the trading window during 25/01-05/04.

- failure to close the trading window during this period, it is alleged that the Noticee has violated the provisions of Clause 4 of Minimum Standards for Code of Conduct to Regulate, Monitor and Report Trading by Insiders mentioned in Schedule B read with Regulation 9(1) of PIT Regulations, 2015. In view of this, adjudication proceedings were initiated against the Noticee under the provisions of section 15HB of the ‘SEBI Act’.

- AO and SEBI find noticee's non-compliance and repeated instances of the same.

- The Adjudicating Officer considered that a repetitive violation, in disregard to the applicable provisions of law, cannot be construed to be a technical violation.

- After taking into consideration the facts and circumstances of the case, material/facts on record, the reply submitted by the Noticee, Adjudicating Officer imposed a penalty of Rs. 5,00,000/- (Rupees Five Lakh only) on the Noticee. The Noticee shall remit / pay the said amount of penalty within 45 days of receipt of this order.

- PACL was a real estate co. selling/purchasing agricultural land.mobilised funds from general public by sponsoring a scheme which was in fact a CIS without registration.

- SEBI investigated and issued a show-cause notice followed by an order to refund the amount collected and restrained the directors from accessing the securities market until such a refund.

- also imposed a 7269.49 cr. penalty paid jointly/severally by co./directors

- appellant being aggrieved filed an appeal contending of never being appointed as a director and not being liable.

- tribunal allowed appeal and set aside AO's order and directed to decide afresh

- based on the tribunal's order,a fresh order imposed 1cr. penalty

- perusal of section 12(1B) clearly indicates that no person shall sponsor or cause to be sponsored or carry on or cause to be carried on any collective investment scheme, unless he obtains a certificate of registration from the Board in accordance with the regulations.

- a/c to shorter oxford dictionary;sponsor = person taking responsibility/standing surety/contributing to bear expenses/support in fundraising by pledging money in advance.

- black's law dictionary defines it as surety; one who makes a promise or gives security for another, particularly a godfather in baptism. In the civil law, one who intervenes for another voluntarily and without being requested.

- based on the above,the appellant has not promised/given surety

- no specific finding by SEBI that appellant was involved

- appellant only director for 50 days and no evidence of attending any meetings

- Thus, the finding of the SEBI that appellant had sponsored and carried on the CIS is patently based on surmises and conjectures.

- in absence of evidence,SEBI wasn't justified especially when SEBI itself noted that month-wise mobilization was unavailable.

- if co. liable to refund and fails to pay, recovery allowable from directors in default.

- vicarious liability in case of co. offence can't be computed automatically.

- contention that being a director of the company the appellant cannot disown his responsibility for the acts of the company is misconceived as there being no hard and fast rule.

- not necessary for every director to be penalized merely on the grounds of being a director if there lies a reasonable explanation from the director.

- Further, as per section 150, a maximum penalty of Rs. 10,000 for each day could be imposed. The appellant was a director only for 50 days and if a maximum penalty of Rs. 10,000 per day is taken into consideration then a maximum penalty of Rs. 5 lakh could be imposed. By no stretch of imagination a penalty of Rs. 1 crore could be imposed.

- SEBI, by separate order has already deemed directors to be directly/instrumentally liable and imposed respective penalties.

- thus,no penalty imposed on appellant,impugned order by SEBI can't be sustained and is quashed.

- appeal allowed

2.17

- appellant,NBFC lending against pledging securities is aggrieved by SEBI's interim order 22/11/2019 filed an appeal.

- aggrieved by the following direction:prohibited transfer of pledged shares by Karvy to the Appellant. The transfer of securities from Karvy shall be permitted only to the respective beneficial owner who has paid in full against these securities, under supervision of NSE.

- Karvy has o/s obligation of 345 cr.+interest towards appellant and rights got destroyed by impugned order.

- by way of a Loan Against Securities Arrangement with Karvy, it has been lending funds towards working capital requirements against pledge of securities since December 2014.

- undertaking by Karvy that such pledged securities owned by Karvy itself

- Karvy violated certain clauses of the loan agreement and withdrew beyond the sanctioned amount a Loan Recall Notice was issued to Karvy seeking refund of the full outstanding loan of Rs. 345 crore (approximately) along with interest and charges.

- failure by Karvy to refund the same the appellant was planning to invoke the pledge. However, on account of the impugned order dated November 22, 2019 which inter alia prohibited transfer of securities.

- appellant not given an opportunity of being heard before impugned order issued

- On becoming aware of the impugned order, immediately on November 23, 2019 despite being a Saturday the appellant sent a representation to SEBI raising all these issues which, however, remain unanswered even today. Such unilateral action by SEBI has left the appellant to face the consequences of the impugned order despite no fault of the appellant.

- Having heard the parties it is found by SAT that the impugned order notes that Karvy had raised funds pledging securities from banks and NBFCs and therefore was aware that rights of those entities would be impacted by the said order.

- appellant was entitled to be heard

- also an undisputed fact that lending against securities is a normal and permitted business activity of banks and NBFCs and SEBI is fully aware of the same.

- SAT considered that impugned order has been prejudicial and adversely affected appellant's rights.

- without commenting on case merits,SAT directs SEBI to hear the appellant and consider the representations

- after giving an opportunity of being heard pass an order

- appeal disposed @ admission with no order on costs

2.18

- 15A to 15HA are penalty provisions and 15I deals with adjudication powers while 15 J states factors to be considered by AO while imposing penalty.

- a/c to the second question, if 15 A to HA are to be mandatorily applied;15 J would stand obliterated/eclipsed. therefore,both should be read in harmony to avoid inconsistency/repugnancy.

- Provision of one section cannot be used to nullify and obtrude another unless it is impossible to reconcile the two provisions. The explanation to Section 15 J of the SEBI Act added by Act No.7 of 2017, quoted above, has clarified and vested in the Adjudicating Officer a discretion under Section 15J on the quantum of penalty to be imposed while adjudicating defaults under Sections 15A to 15HA.

- second referred question stands fully answered by clarification through the medium of enacting the Explanation to Section 15J vide Act No.7 to 2017, which also states that the Adjudicating Officer shall always have deemed to have exercised and applied the provision. We, therefore, deem it appropriate to hold that the provisions of Section 15J were never eclipsed and had continued to apply in terms thereof to the defaults under Section 15A(a) of the SEBI Act.

- as per a reference order,15A(a) could even apply to technical defaults of small amounts and minimum mandatory penalty would be disproportionate/arbitrary.

- legislative intent wasn't to curtail AO's discretion notwithstanding that default was technical;no loss caused to investor

- The 2014 amendment wasn't retrospective and therefore,clarificatory

- normally "whichever is less" would hint towards absence of discretion but we shall consider the legislative intent primarily;keeping in view aggravating/mitigating circumstances.

- we are inclined to take the view that the provisions of clauses (a), (b) and (c) of Section 15J are illustrative in nature and have to be taken into account whenever such circumstances exist. But this is not to say that there can be no other circumstance(s) beyond those enumerated in clauses (a), (b) and (c) of Section 15J that the Adjudicating Officer is precluded in law from considering.

- a narrow view would conflict with Section 151(2) vesting penalty jurisdiction in AO

- Therefore, to understand the conditions stipulated in clauses (a), (b) and (c) of Section 15J to be exhaustive and admitting of no exception or vesting any discretion in the Adjudicating Officer would be virtually to admit/concede that in adjudications involving penalties under Sections 15 A, 15B and 15C, Section 15J will have no application.

- We therefore believe it to be non exhaustive and AO can consider them while imposing penalties.

- distinction among continuing/repeat offence

- “continuing offence” was explained and elucidated by giving several illustrations in State of Bihar vs. Deokaran Nenshi & Ors. (1972) 2 SCC 890. In case of continuing offence, the liability continues until the rule or its requirement is obeyed or complied with.

- On every occasion when disobedience or noncompliance occurs and reoccurs, there is an offence committed.

- Continuing offence constitutes a fresh offence every time or occasion it occurs.

- In Union of India & Anr. Vs. Tarsem Singh (2008) 8 SCC 648, continuing offence or default in service law was explained as a single wrongful act which causes a continuing injury.

- A recurring or successive wrong, on the other hand, are those which occur periodically with each wrong giving rise to a distinct and separate cause of action.

- We have made reference to this legal position in view of clause (c) of Section 15J of the SEBI Act which refers to the repetitive nature of default and not a continuing default.

- this dictum, however, does not mean that factum of continuing default is not a relevant factor, as we have held that clauses (a) to (c) in Section 15J of the SEBI Act are merely illustrative and are not the only grounds/factors which can be taken into consideration.

- 28A inserted to provide a recovery mechanism relating to Section 220 of income tax act have been incorporated

- on failure,Recovery Officer (RO) shall draw statement/certificate and recover by the modes specified therein

- Tribunal on 10/03/2017 decided that interest liability is automatic and arises by legal operation

- further find that the Adjudicating Officer in its order while imposing penalty had also directed the appellant to pay the penalty amount within 45 days. In our view this order of penalty would also be deemed to include a notice of demand and thus a formal requirement for issuance of a separate notice of demand pursuant to the order of penalty is no longer required. Thus, the contention raised by the appellant is not sustainable and is rejected.

- interest impliedly waived when penalty reduced or interest non imposable with retrospective effect is patently misconceived;as affirmed by the Supreme Court.

- From the aforesaid, it becomes clear that interest was not only chargeable under Section 28A read with Section 220(2) of the Income Tax Act but the provisions of Interest Act, 1978 could also be taken into consideration and interest could be charged from the date on which the penalty became due.

- RO was justified in charging interest from the date of AO's order and no merit was found in these appeals followed by being dismissed with no order on costs.

2.20

- acquisition of miniscule proportions above permitted limits between promoters.

- In the case of Nirma Industries Ltd & Anr v. SEBI (2013) 8 SCC 20, the Hon’ble Supreme Court in para 17 observed that in the given set of circumstances of that case the withdrawal of the open offer to acquire 20 percent of shared of the Company was neither in the interest of the investor nor in the development of the securities market.

- In the case of SEBI v. Kishore R. Ajmera (2016) 6 SCC 368, the Hon’ble Supreme Court found that the manipulative and fraudulent market practices are required to be curbed by brining a comparative legislative to bring about some clarity and certainty which cannot be disputed.

- In the present case,takeover violations only up to 0.04% are between promoters via the open market.

- a/c to SAT public announcement (PA) would be disproportionate

- In the circumstance, the directions as provided by Rule 32(1) (b) of the Takeover Regulations as cited supra would meet the ends of justice. The appellant can be directed to transfer 0.04 percent shares i.e. 2000 shares through open market and to direct to deposit an amount of Rs.3,60,300/- (2000 shares x Rs.180.15 : purchase price) in the Investor Protection and Education Fund would meet the ends of justice.

- appeal partly allowed and making PA+interest @ 10% are set aside

- instead, appellant is directed to transfer 3,60,000 to IEPF per Rule 32(1) within 6 weeks from this order

- 12% interest in case of default from order to deposit

2.21

- SAT doesn't agree with it only being a technical violation

- clearly,cheques received from clients but not credited in accounts upfront which is a basic requirement of margin collection.

- submission that margin requirement as on T + 5, not as on the trading day, is what is relevant is not correct and hence not admissible. Upfront collection of margins is an important mechanism for ensuring prompt settlement and in promoting market integrity. As such any explanation to the contrary is not sustainable.

- SAT can't agree with SEBI circular & NSE that no discretion can be exercisable while imposing penalty

- specifies a small proportion of 5% to 10% of margin shortfall as penalty for non-reporting, it specifies that 100% of the short collection shall be imposed as penalty. If such violation is noticed at the time of inspection, then in addition to 100% penalty one day suspension has to be imposed. The said circular does not differentiate between situations involving upfront collection of cheques but late depositing or late crediting of the said amount and no upfront collection at all and hence suffers from the proportionality principle.

- to incorporate proportionality; "shall" must be read as "may" which enables distinction between no margin collection and delayed collection.

- current penalty and suspension imposed seem somewhat delusional

- appellant submits that undisputed annual income from brokerage is only 3 lakhs and hasn't committed another violation

- penalty can be appealed/reviewed/rescinded/reconsidered to incorporate proportionality

- inclined to reduce penalty but still in tune with violation.

- undisputed annual income is incomplete

- imperative to underscore the importance of prompt upfront margin collection for promoting market integrity. Balancing all these, a penalty of Rupees Fifty Lakh and one day suspension from the CD segment would meet the ends of justice in the matter.

- to be paid within 4 weeks and suspension implemented after giving 15 days notice

2.22

- allegation proof must be direct substantive evidence or inferred by the logical process of reasoning from attending facts/circumstances.

- direct evidence is more certain but courts should also come to a reasonable conclusion in its absence

- in CA 2818, both clients are known to each other and were related entities

- also known to sub-broker/respondent-broker

- clients engaged in mutual buy and sell of significant volume of illiquid scrip

- except above no material evidence to prove lack of vigilance/bona-fides.so,as it has been held in the order of the Whole Time Member, SEBI which, according to us, was rightly reversed in appeal by the Securities Appellate Tribunal(SAT).

- among 2nd/3rd category; trading volume was huge

- buy and sell orders made within 0-60 seconds which may not be conclusive in isolation; but coupled with above can reasonably point to fraud/manipulation with prior meeting if minds.

- when the same transactions are made between the same set/group of brokers for synchronized trades resulting in large volumes of fictitious trading.

- trades weren't negotiated trades executed a/c to board's circular or within permissible parameters

- conclusion has to be gathered from various circumstances like that volume of the trade affected; the period of persistence in trading in the particular scrip; the particulars of the buy and sell orders, namely, the volume thereof; the proximity of time between the two and such other relevant factors.

- when the broker has himself initiated the sale and ultimately equal scrip has come back,trading has gone on without settlement of accounts i.e. without any payment and the volume of trading in the illiquid scrips, all, should raise a serious doubt in a reasonable man as to whether the trades are genuine.

- failure of brokers to alert themselves of this minimum requirement and trading persistence would not only disclose negligence but also demonstrate a deliberate intention to indulge and thereby attracting FUTP regulations.

- The dividing line would be drawn on the basis of trading persistence and volume along with time period.

2.23

- SEBI vide an ex-parte interim order dated 03/06/2015 prima facie observed that NTL engaged in fund mobilizing through issue of NCDs and violated co. act,1956 and SEBI regulations, 2008

- companies and directors deny any violations

- The company offered NCDs to 341 people during 2013-14 and mobilised 5.96 crores and made a public issue.

- The company contended them as "deposits" and that SEBI wouldn't have jurisdiction but as they admittedly issued debentures;SEBI would have jurisdiction.

- The company allegedly failed to pay interest or pay the money back and allegedly violated co. act,2013/1956 along with ILDS regulations,2008.

- co. had to compulsorily list the NCDs per law by applying to 1/more stock exchanges for permission to be dealt and no record of co. doing such.

- hence, co./directors have to repay NCDs within 8 days after it becomes liable to repay.

- liability of the Company to refund the public funds collected through offer and allotment of the impugned securities is continuing and such liability would continue till repayments are made.

- There is no record to suggest that the Company made the refunds as per law.

- as repayment failed to be refunded; interest @ 15% as per rule 4D (which prescribes that the rates of interest, for the purposes of subsections (2) and (2A) of section 73, shall be 15 per cent per annum) of the Companies (Central Government’s) General Rules and Forms, 1956 from liability date till actual payment.

- Section 117C stipulates creating a debenture redemption reserve from out of profits every year until redemption and no record of such too

- as NCDs are debt securities,co. has to comply with ILDS regulations which the co. failed to

- therefore,co. liable for suitable action including action for default under 73(2) of co. act,1956

2.24

- said 553 demat a/c holders sold shares to respondents @ rs.1170/- per share though market share was more than 1170 per share.

- respondents further sold at a higher price

- upon investigation,most of those demat a/c holders weren't genuine persons

- SEBI concluded that respondents' dealings weren't fair and in violation of laws and imposed penalties on respondents.

- on appeal,SAT set aside SEBI's order and so, SEBI challenged SAT's order before the Supreme Court

- appeal allowed

- SAT finds no substance that price paid to demat a/c holders was reasonable.

- value differed from 1172 to 1339 and all at the same rates per share to respondents. deemed fishy in nature

- no RII made any complaint not relevant as SEBI may also act suo-moto

- due to undue advantage to respondents,some small investor/RII must not have gotten the shares

- SAT doesn't agree that not one but many same addresses state no irregularity as rarely would a person give someone else's address.

- pertinent to note that upon initiation of an inquiry at the instance of the SEBI, most of the demat accounts had been closed.

- respondents submitted that sales can't be legal if stocks weren't listed.

- facts and circumstances of the case, we do not accept the said submission made by the learned counsel appearing for the respondents.

- The tribunal is a final fact finding authority can't be disputed and SAT found facts can't be disregarded.

- whereas SAT ought to record specific reasons for varied conclusions but the supreme court can't find the same whereas there is a detailed order of SEBI coming to its conclusion by WTM.

2.25

- burren entered into a Share Purchase Agreement (SPA) with UIC on 14/02/2005 to acquire the entire UBL and appointed 2 directors on UBL's board

- burren then held 26.01% in target co. as being more than 15%;Public Announcement (PA) obligations were attracted

- PA made for 20% shares @ 92.41 per fully paid-up equity on 15/02

- director appointment amounted to a violation of Regulation 22(7) of the Regulations inasmuch as the said appointment was made during the offer period which had commenced on and from 14th February, 2005 i.e.date of execution of the share purchase agreement.

- The adjudicating authority imposed a penalty of Rs.25 lakhs set aside by SAT and appealed against by SEBI to Supreme Court

- appeal allowed

- appellant contended that Memorandum of Understanding may also include a concluded agreement

- even if MoU falls short of concluded agreement and agreement is executed subsequently,the offer period will still commence.

- based on the above,according to the learned counsel, there is no reason why the same should not commence from the date of share purchase agreement when the parties had not executed a Memorandum of Understanding.

- It is also submitted that the commencement of the ‘offer period’ from public announcement would primarily have relevance to a case where acquisition of shares is from the market and there is no Memorandum of Understanding or a concluded agreement.

- respondents replied that regulations cannot apply as appointment disqualifications operate only when acquirers/PACs are individuals and not corp. entities and Supreme Court doesn't accept it

- whereas,a concluded agreement isn't contemplated to be the starting point of offer period,but such must naturally follow once offer period commences from MoU date;which would reflect principle agreement falling sort of a binding contract.

- if the offer period can be triggered by an incomplete agreement a.k.a an understanding, then the offer period can also be started from a concluded agreement (SPA in present case).

- we believe the learned tribunal concluded incorrectly and wrongly reversed AO's order.

- Consequently the order of the learned Tribunal is set aside and that of the Adjudicating Officer is restored. The penalty awarded by the Adjudicating Officer by order dated 25th August, 2006 shall be deposited in the manner directed within two months.

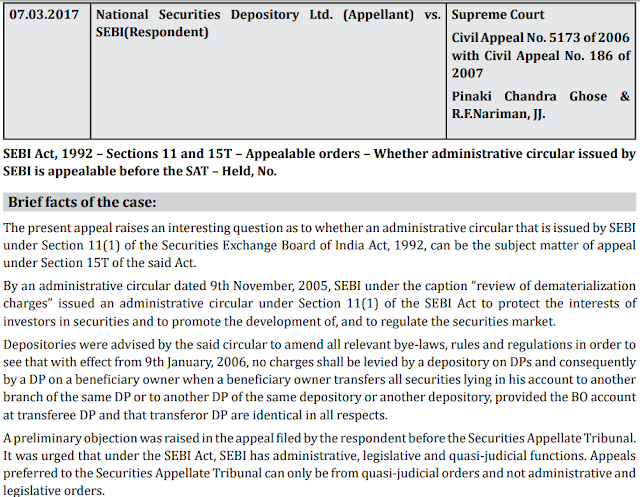

- SAT turned down preliminary objection by impugned judgement 29/09/2006

- "order"- a wide term and can be appealed against all types.

- held purportedly following the decision in Clariant International Ltd. & Anr. v. Securities & Exchange Board of India [(2004) 8 SCC 524].

- The Tribunal, therefore, rejected the preliminary objection and went into the merits of the arguments against the impugned and dismissed it.

- cross appeals filed by NSDL on merits of dismissal whereas appeal filed by SEBI against preliminary objection before SAT.

- SEBI appeal allowed as preliminary objection is sustained and NSDL's dismissed with setting aside SAT orders.

- we will take a second appeal as if first were to succeed,merits wouldn't have gone into.

- Administrative orders such as circulars issued under the present case referable to Section 11(1) of the Act are obviously outside the appellate jurisdiction of the Tribunal.

- orders referable to Sections 11(4), 11(b), 11(d), 12(3) and 15-I of the Act, being quasi-judicial orders, and quasi- judicial orders made under the Rules and Regulations that are the subject matter of appeal under Section 15T.

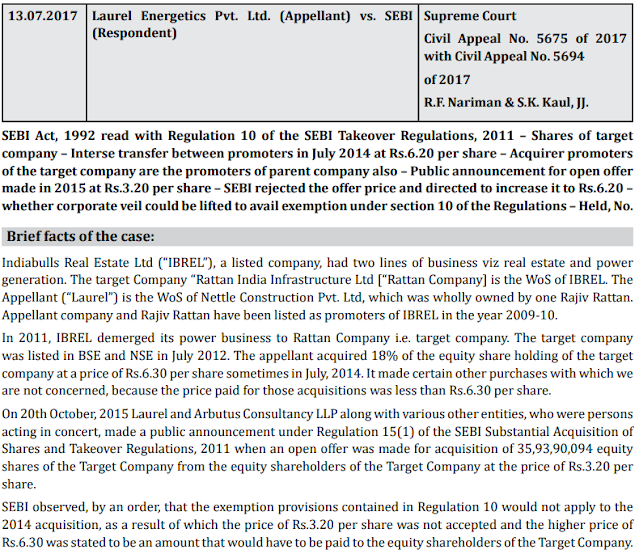

2.27

- corporate veil is lifted in special circumstances

- holding and subsidiaries are treated as one subject to control being exclusively held by the same person

- a/c to persons acting in concert,period should be 3/more years prior to proposed acquisition and disclosed as such except in the case of target co. shareholders.

- impermissible for the court to lift the corporate veil,either partially or otherwise that would disturb the regulation's plain language or where the regulation doesn't specifically state as such.

- In the present case,it is impossible to construe the regulation in light of it's object when words are clear but can be used as an extrinsic aid to interpretation where there is ambiguity

- The Supreme court finds literal language clear and beyond any doubt,even when contrasted with sub regulations as held above.

- The tribunal's conclusion can't be faulted and accordingly appeals stand dismissed.

2.28

- examination of interest act,1978 would establish that interest can be granted in equity for causes of action from cause date until institution of proceedings.

- In the present case,interest is payable in equity for all SEBI-collected penalties that would be credited to the Consolidated Fund under 15JA

- no greater equity than such money being used for public purposes/depriving from using in malpractices

- 28A=procedural law and would ordinarily be retrospective,interest levy=substantive law;correctly stated by tribunal to be prospective

- tribunal's finding was set aside that no interest could be charged from penalty due date

- civil appeals allowed as far as penalty is concerned

- SEBI passed similar orders in other cases where WTM was fully cognizant of their power to grant future interest.

- in the last mentioned case, whose facts are very similar to the facts of the present case, the order was passed “without prejudice to SEBI’s right to enforce disgorgement along with further interest till actual payment is made.”

- if default,no future interest payable as a much severe penalty of debarment for 7 years was imposed

- SEBI noticed debarment as well as payment was witnessed

- SAT was incorrect that order dated 21/07/2009 contained interest obligation @ 12% on unlawful gain of 4.05 crores till payment

- SAT's judgement is set aside and appeal allowed

2.29

- dichotomy between stock exchange functions & SEBI functions

- licences given by the stock exchange enables the stock- broker to buy and sell securities on the exchange whereas the regulation of the trade per se is done by SEBI for which it is entitled to charge requisite registration fees.

- In the present case,the merger created a new entity (RCML) with a right to operate in the derivative segment and had to pay fresh registration fees on a turnover basis.

- RCML not entitled to fee continuity benefit

- a/c to RCML; merger happened due to acceptance of GUPTA committee's recommendations by SEBI which put forth a prerequisite of having 3cr./more net worth for entering the derivative market.

- above constituted a law compulsion and hence, appellants entitled to circular dated 30/09/2002.

- Supreme Court finds no merit in above argument that SEBI abused power in companies act by demanding fresh registration/turnover fee

- We make it clear that it would depend on the facts of each case whether a scheme under section 391 could be construed as an alternative to liquidation.

- circular dated 30/09/2002 provides exemption to those entities that merge as an alternative to liquidation,i.e. if co. has -ve net worth or on the brink of liquidation which isn't the case presently.

- amalgamation has happened to increase "reserves" of net worth. difference between the amount recorded as fresh share capital issued by the transferee company on amalgamation and the amount of share capital of the transferor company to be reflected in the Revenue Reserve(s) of the transferee company was the sole object behind amalgamation.

- therefore,SEBI was right to refuse the benefit to transferee co.

- Under the 1992 Act, a statutory duty was cast on SEBI to protect the interest of investors in securities and to regulate the trade in securities on the Stock Exchange. Such Regulation is not a part of the Companies Act.

- so, entitled to charge a registration fee

- The derivative market is highly speculative and to a certain extent replaces badla

- so,gupta committee recommendations were made to protect investors but made no legal obligation to merge

- In the present case, we are not concerned with merger of firms. In the present case, we are not concerned with joint ventures. After the merger of RSL into RCML a new entity has emerged. In the circumstances, SEBI was entitled to charge the stipulated fees.

2.30

- presently,an underwriting agreement dated 26/09/2017 according to prescribed format states that underwriters undertake such in case of unsubscription

- agreement vetted by NSE before public issue was opened

- ICDR regulations stipulate for merchant bankers to underwrite 15% issue size and cover if other merchant bankers/investors don't come through.

- on the other hand,an underwriting agreement permits underwriters to procure apps from investors.

- further provides that in the event of failure by the underwriters to subscribe to the shares, the issuer company shall be free to make arrangement with one or more persons to subscribe to such shares without prejudice to the rights of the issuer company to take such measures and proceedings as may be available to it against the underwriters including the right to claim damage for any loss suffered by the company by reason of failure on part of the underwriters to subscribe to the shares.

- The present agreement fits the standard so NSE,not justified in rejecting allotment basis on grounds that underwriters failed to subscribe.

- In these circumstances, in the interest of investors and the securities market, we dispose of the appeal by passing the following order:-

- (a) The impugned communication of NSE dated April 6, 2018 is quashed and set aside;

- (b) Appellant is at liberty to ascertain from the underwriters within 3 days from today as to whether they are ready and willing to discharge their obligation set out in regulation 106P of the ICDR Regulations and intimate the same to the NSE immediately thereafter.

- (c) If the underwriters express their inability to discharge their obligation under the ICDR Regulations, then the appellant company be permitted to take into consideration the shares subscribed by the 8 investors and proceed to complete the public issue process.

- (d) If the underwriters agree to discharge their obligation set out in the ICDR Regulations, then, in the peculiar facts of the present case, no action needs to be taken against the underwriters.

- SAT deems it proper to bring to SEBI's notice that ICDR regulation and model underwriting agreement don't align and that SEBI addresses it expeditiously and ensures obligatory clarifications.

2.31

- in the SEBI master circular dated 31/12/2010 all registered. intermediaries directed to comply with requirements contained in it.

- subsequent amendments required immediate adoption but no time schedule which shall be presumed to be earliest.

- appellant has adopted the requirements, although belatedly.

- We have also noted that for delayed implementation / violation SEBI has imposed varying penalties including no penalty in some cases.

- however 15HB of SEBI act read with 19G of depositories act penalty shall be 1 lakh-1 cr.

- penalty shall be in tune with all provisions

- as policy/procedures were implemented although belatedly.

- a/c to penalty precedents, 40 lakhs is too excessive and therefore reduces it to 6 lakhs.

2.32: NSE dark-fibre/co-location case

Order dated January 16, 2020 in the matter of NSE- Dark Fibre. Detailed order is available at

No comments:

Post a Comment