1.1

- first ques. of law:whether formation of opinion by the Appellate Tribunal that the company’s affairs have been or are being conducted in a manner prejudicial and oppressive to some members and that the facts otherwise justify the winding up of the company on just and equitable ground, is in tune with the well settled principles and parameters especially in the light of the fact that the findings of NCLT on facts were not individually and specifically overturned by the Appellate Tribunal?

- TATA SONS is a principal investment holding co. in which major shareholders are philanthropic trusts. Therefore, NCLAT should have raised the most fundamental question whether it would be equitable to wind up the Company and thereby starve to death those charitable Trusts.

- second ques. of law:whether the reliefs granted, and directions issued by NCLAT including the reinstatement of CPM into the Board are in consonance with (i) the pleadings made, (ii) the reliefs sought and (iii) powers under 242(2).

- original motive was to restrain from removing CPM as director and further reinstatement of a representative from complainant co.

- the object can't be to provide a remedy worse than the disease

- hence, NCLAT shouldn't have granted the reliefs of (i) reinstatement of CPM (ii) restriction on the right to invoke Article 75 (iii) restraining RNT and the Nominee Directors from taking decisions in advance and (iv) setting aside the conversion of Tata Sons into a private co.

- third ques. of law:whether NCLAT could've muted the power of co. under article 75 of the Articles of Association (AoA),to demand any member to transfer his shares, by injuncting the company from exercising the rights under the Article, even while refusing to set aside the Article.

- It was contended that Article 75 was repugnant to Sections 235 and 236 of the Companies Act, 2013. We do not know how these provisions would apply.These provisions have no relevance to the case on hand.

- the contention revolving around Section 58(2) is wholly unsustainable, as Section 58(2) deals with securities or other interests of any member of a Public Company. Therefore, the order of NCLAT tinkering with the power available under Article 75 of the Articles of Association is wholly unsustainable.if the relief granted by NCLAT itself is contrary to law, the prayer of the S.P. Group in their Appeal asking for more, is nothing but a request for aggravating the illegality.

- fourth ques. of law: whether tribunal's characterisation of affirmative voting rights under article 121 of AoA to trust-nominated directors as oppressive and prejudicial is justified and whether Tribunal could have granted a direction to RNT and Nominee directors virtually nullifying the effect of these Articles.

- if we apply Section 152(2) strictly, the Trusts which own 66% of the paid-up capital will be entitled to pack the Board with their own Directors. But under Article 104B, only a minimum guarantee is provided to Trusts, by ensuring that Trusts will have at least 1/3 rd of Directors, nominated by them so long as they hold 40% in aggregate of the paid-up share capital.

- Article 94 of TATA SONS correlates with Section 47(1)(b) stating that voting rights of members in a poll will be proportionate to their share in the paid-up capital giving the rightful authority to majority.

- Section 166(2) is a combination of public as well as private interest but as the directors are nominated by charitable trusts; the interests are purely public. therefore, affirmative voting rights hold true to their validity.

- If the company’s affairs have been conducted in a manner oppressive or prejudicial to the interests of the S.P. group, we wonder how a representative of the S.P. Group holding a little over 18% of the share capital could have moved up to the topmost position within a period of six years of his induction. Therefore, we are of the considered view that the claim for proportionate representation on the Board is neither statutorily or contractually sustainable nor factually justified.

- Section 163 doesn't translate to minority representation in the board but it talks of ranking candidates on the basis of preference and the co. may or ma not choose to provide for the same in articles. hence, not compulsory.

- fifth ques. of law:whether reconversion of TATA SONS from public to private, requied the necessary approval under Section 14 OR an action under Section 43A(4) of 1956 act during 2000-2013?

- dispute regards only the procedure for reconversion

- While on the one hand, NCLAT took note of the “lethargy” on the part of Tata Sons in taking action for reconversion, NCLAT, on the other hand also took adverse notice of the speed with which they swung into action after the dismissal of the complaint by NCLT.

- TATA SONS didn't go public by choice by by operation of law so some flexibility can be given in following Section 14(1)(b). they wanted an amended Certificate of Incorporation which isn't covered in Section 14. NCLAT mixed up the attempt of Tata Sons to have the Certificate of Incorporation amended, with an attempt to have the Articles of Association amended. Since Tata Sons satisfied the criteria prescribed in Section 2(68) of the 2013 Act, they applied to the Registrar of companies for amendment of the certificate. The certificate is a mere recognition of the status of the company, and it does not by itself create one.

- Section 43A(2A) continued to be in force till 30/01/2019 and hence the procedure adopted by Tata Sons and the RoC in July/August 2018 when section 43A(2A) was still available, was perfectly in order.

- Thus, in fine, all the questions of law are liable to be answered in favour of the appellants Tata group and the appeals filed by the Tata Group are liable to be allowed and the appeal filed by S.P. Group is liable to be dismissed.

- FOR MORE DETAILS, PLEASE REFER TO THE SUPREME COURT JUDGEMENT OR ICSI STUDY MATERIAL.

1.2

- The purpose of the ineligibility under Section 29A is to achieve sustainable revival and ensure that who is the cause of the problem either by design or default cannot be a part of the process of solution. Section 29A, encompasses not only conduct in relation to the corporate debtor but in relation to other companies as well.

- linkage of Section 230 and IBC is crucial for the present case.

- IBC enunciates the gamut of proceedings fro liquidation and one of the revival modes in enlisted in Section 230's enabling provisions to which liquidator can take recourse.

- liquidator's statutory duties don't cease after inviting a scheme under Section 230.

- consequence of the approval of the scheme and its sanction thereafter by the Tribunal is that the scheme attains a binding character upon stakeholders including liquidator appointed under IBC.

- whereas, it would be misleading to state that Section 230 is not connected to IBC as 230 is much wider in a sense also applied to an entity not subjected to IBC.

- but as present case is concerned, both shall be read and interpreted in harmony.

- It would lead to a manifest absurdity if the persons ineligible for submitting a resolution plan, participating in the sale of assets in liquidation or participating in the sale of the corporate debtor as a ‘going concern’, are somehow permitted to propose a compromise or arrangement under Section 230.

- as the provisions of Section 29A of IBC are similar to Section 35(1)(f).it would be far-fetched to hold that the ineligibilities under Section 35(1)(f) read with Section 29A would not apply when Section 230 is invoked. Such an interpretation would result in defeating the provisions of the IBC and must be eschewed.

- An argument has also been advanced by the appellants and petitioners that attaching the ineligibilities under Section 29A and Section 35(1)(f) of the IBC to a scheme under Section 230 would be violative of Article 14 of the Constitution as the appellant would be “deemed ineligible” to submit a proposal under Section 230 of the Act of 2013. We find no merit in this contention. As explained above, the stages of submitting a resolution plan, selling assets of a company in liquidation, and selling the company as a going concern during liquidation, all indicate that the promoter or those in the management of the company must not be allowed a back-door entry in the company and are hence, ineligible to participate during these stages.

- Regulation 2B of the Liquidation Process Regulations, specifically the proviso to Regulation 2B(1), is also constitutionally valid. For the above reasons, we have come to the conclusion that there is no merit in the appeals and the writ petition. The civil appeals and writ petition are accordingly dismissed.

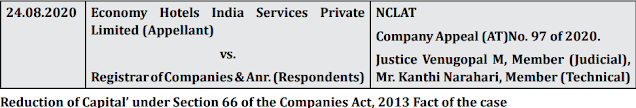

1.3

- No proper genuine reason has been given for reduction of share capital.

- non-promoter shareholders asked to dispose their shareholding.there is no law holding that co. can reduce it's share cap only to reduce accumulated losses.so,no genuine reason was recorded.

- Consent affidavit from creditors not obtained.

- after notice service, no representation were made by creditors within 3 months.hence,presumed nil objections.

- therefore,we are of the view that the observation of Learned Tribunal in Para 11 of the impugned order “It is observed that while objections have not been received from creditors, neither has any consent affidavits on their behalf been produced, with regard to reduction of share capital.” is erroneous.

- Security Premium Account(SPA) cannot be utilized for making payment to non-promoter shareholders.

- the regional director of the northern region presented such argument as under Section 78(2).

- if such is accepted,it would otiose Section 78(1) and wouldn't construed as harmonious construction.

- after considering various judgements, that SPA can be used to pay non-promoter shareholders.

- Selective reduction of shareholders is not permissible

- clearly, majority has decided to reduce the share cap and the amount concerned which shall as per norm prevail.they may decide to target a specific group but without bad intentions.thus, it can't be treated as buy-back and concerned provisions wouldn't be attracted.

- selective reduction permissible if offered a fair value and in present case,no objections have been raised regarding valuation.and the whole non-promoter shareholder group is involved.

- Petition for reduction of capital under Section 66 is not maintainable.However, may be filed under Section 230-232.

- Section 66 is for share cap reduction without it being part of a scheme and a scheme of buyback would be inefficient for shareholders that have prayed for exit opportunity.

- in the Articles of co;under A45,47 the co. shall reduce capital by a special resolution and the co. has complied the same with Section 171 securing untraceable non-promoter shareholder's rights.

- THUS,we are of the view that the Tribunal has erroneously held that the Application for reduction of share is .not maintainable under Section 66 and dismissed the Application on untenable grounds. Therefore, we hereby set aside the impugned order passed by Tribunal and reduction of share capital resolved is hereby confirmed.

1.4

- After hearing the Ld. Counsel for the parties, we have considered their rival submissions and examined the record. In the application, there is a vague allegation of fabricating, share transfer deeds and the resignation letter.After hearing the Ld. Counsel for the parties, we have considered their rival submissions and examined the record. In the application, there is a vague allegation of fabricating, share transfer deeds and the resignation letter.

- it isn't mentioned how mr.Naveen Kishore siphoned off the money from appelant and when he purchased 50 properties in his relative's name out of co. funds. also, no mention is seen of how and when got to know of this, neither have the respondents placed any documents.

- The Hon’ble Supreme Court in the case of Karanti Associates Pvt. Ltd. & Ors. Vs. Masood Ahmad Khan & Ors. (2010) 9 SCC 496 after considering many earlier judgments summarized the principles on the recording of reasons. In light of the principles laid down by the Hon’ble Supreme Court, we have examined the Impugned Order.

- nothing in the order justifies a forensic audit dating as far as 15 years. the authority must record reason in support of conclusions;but in the concerned order, no such reasons are mentioned making it cryptic and non-speaking. hence,it can't be sustained and we must set aside the impugned order.

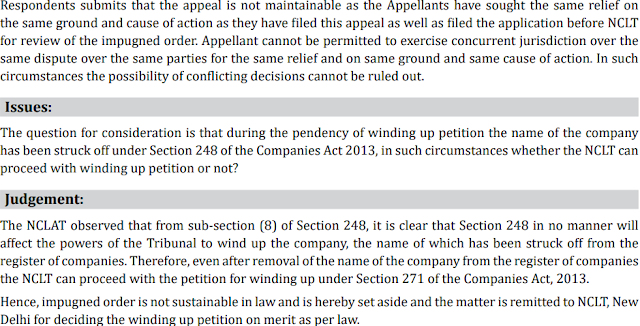

1.5

- MAIN ISSUES

- circumstances under which a winding up proceeding pending on the file of a High Court could be transferred to the NCLT

- At whose instance, such transfer could be ordered

- any & all creditors are a party to winding up proceedings irrespective of the number of initiators. hence, the word PARTY can't be interpreted for only a single petitioning creditor.

- the same is deduced by deductive logic as any aggrieved creditor may approach the co. court against the official liquidator and become a party under 1956 act.

- Instead of asking a party to adopt such a circuitous route and then take recourse to the 5th proviso to section 434(1)(c), it would be better to recognize the right of such a party to seek transfer directly.

- As observed by this Court in Forech India Limited (supra), the object of IBC will be stultified if parallel proceedings are allowed to go on in different fora.

- if Allahabad HC is allowed to wind up and NCLT allowed to inquire into the IBC application, IBC would stand defeated.

- thus, the petitioner shall be considered a petitioner and entitled to seek tranfer to NCLT.

- therefore,impugned order of the High court rejecting the petition for transfer on basis of Rule 26 of the Companies (Court) Rules, 1959 is flawed. Therefore, the appeal is allowed.

- the impugned order is set aside and the winding up ordered to be transferred to NCLT along with appellant application.

- no order as to costs

1.6

- NCLAT noted that a notice shall be sent to respective authorities likely to be affected as prescribed under the relevant section and that, representations are to be made by them within 30 days from notice receipt under Section 230(5) failing which, assumed NO objection.

- basic intent is to inform said authorities and get them to work harmoniously with tribunal ensuring that scheme follows all norms and isn't violative of the public policy.

- the regional director's objection have been overruled stating it is only on a procedural aspect which comes under tribunal's jurisdiction rather than to raise illegality in the scheme itself.

- law compliance is part of public policy and the adjudicating authority shall clinch compliances rather than defaults.

- Scheme under section 230 of Companies Act, 2013 cannot be used as a method of rectification of the actions already taken. Before the scheme gets approved, the company must be in compliance with all the public authorities and should come out clean. There must be no actions pending against the company by the public authorities before sanctioning.

- in light of the above observations the appeal is allowed and National Company Law Appellate Tribunal aside the impugned order dated 6th July, 2020 passed by National Company Law Tribunal, Mumbai.

1.7

- as respondent,i.e,the son isn't holding the eligible shareholding,i.e,10% under Section 244.

- he has purchased 0.03% in M/s Oswal Agro Mills in 06/'17 after filing civil suit and remaining 9.97% is in dispute claiming on being a legal representative.

- his right as to those shares is to be determined finally in the civil suit which will bind all parties involved.

- It would not be appropriate to entertain these parallel proceedings and give waiver as claimed under section 244 before the civil suit’s decision. Respondent No.1 had himself chosen to avail the remedy of civil suit, as such filing of an application under sections 241 and 242 after that is nothing but an afterthought.

- it is admitted by the son of no involvement in day-to-day affairs of the co.

- in this case,the son's rights are protected in the civil suit and he doesn't constitute the shareholders eligible to maintain such a petition.

- as the high court issued orders maintaining the status quo, the shares shall be currently considered under the appellant's name.

- We refrain to decide the question finally in these proceedings concerning the effect of nomination, as it being a civil dispute, cannot be decided in these proceedings and the decision may jeopardize parties’ rights and interest in the civil suit.

- it prima facie doesn't appear to be a case of oppression & management according to NCLT.

- NCLT deems it apt to drop the proceedings with the liberty to file afresh if the civil suit is decided in the son's favor.

- We reiterate that we have left all the questions to be decided in the pending civil suit. Impugned orders passed by the NCLT as well as NCLAT are set aside, and the appeals are allowed to the aforesaid extent. We request that the civil suit be decided as expeditiously as possible, subject to cooperation by respondent No.1. Parties to bear their costs as incurred.

1.8

- judgment in Mukut Pathak & Ors. v. Union of India & Ors., 265 (2019) DLT 506, insofar as the merits of the case is concerned, is squarely applicable in the present case.

- proviso to Section 167(1) can't be read retrospectively and it being a punitive measure can't be read retrospectively unless specifically called for.

- the Co. Fresh Start Scheme (CFSS) has aided the co. that have defaulted in filing their financial statements so that they bear no disqualifications/penalties and provides directors,the cause of action to challenge their disqualifications.

- in the present case,the disqualified directors would have to endure hardships in availing remedies for the active co. which defeats the object of CFSS.

- the disqualification wouldn't just affect the petitioners/directors but also the active co.

- Considering the COVID-19 pandemic, the MCA has launched the Fresh Start Scheme-2020, which ought to be given full effect. It is not uncommon to see directors of one company being directors in another company. Under such circumstances, to disqualify directors permanently and not allowing them to avail of their DINs and DSCs could render the Scheme itself nugatory.

- in the fitness of things and also in view of the judgment in Mukut Pathak (supra), the disqualification of the Petitioners as Directors is set aside. The DINs and DSCs of the Petitioners are directed to be reactivated, within a period of three working days.

1.9 (same as 1.6)

1.10

- co. name struck off by ROC Mumbai and principal Income Tax commissioner challenged ROC's order before NCLT,mumbai bench under Section 252.

- Company has certain Financial transactions that have been entered into by the Company for the Assessment year 2011-12 and information regarding this were received from the office of ITO Income Tax Officer 15 (3) (2) Mumbai. However, no return of income has been filed.

- therefore notice under the income tax has been issued for assessing/re-assessing income.

- it is difficult to assess the defunct Company and it will cause huge loss of revenue to the Government of India. Hence, it was prayed that the name of the Company be restore in the Register of Companies.

- ROC's representative stated before tribunal that they don't have no objection on name restoration.

- NCLT, Mumbai Bench by the impugned order allowed the Appeal and directed to restore the name of the Company in the Register of Companies. However, before passing of impugned order no notice has been served on the Company, but the Company was arrayed as the Respondent.

- being aggrieved by this order the appellant ex-director and majority shareholder holding power of attorney have filed the above appeal stating that Section 252(1) and rule 37 of NCLT rules,2016 provide for a reasonable opportunity or a notice to show cause on hearing date.

- The NCLAT held that without giving any opportunity of being heard, the order has been passed by the NCLT. Hence, the order is not sustainable in law. Therefore, it is set aside, and the matter is remitted back to the NCLT, Mumbai bench with the direction that after hearing the parties decide the said appeal under Section 252 of the Companies Act, 2013, as per law without influence by its earlier Order.

1.11

1.12

- petitioner submitted of no specific allegation in SFIO report of connection/connivance of the nominee director,i.e,the petitioner.

- also mentioned that mere inclusion in the list of allegedly liable without any specific role/misconduct isn't sufficient for summons.

- therefore, making the impugned orders erroneous.

- respondent submitted that petitioner was a Nominee Director appointed by PNB on the Board of BSL and was expected to be independent, vigilant and cautious against any fraudulent acts and required to raise red flags and inform PNB of any fraudulent activity.

- high court observed that no allegation maintained of petitioner's involvement and wasn't assigned any kind of executive work.

- material difference between allegation that Nominee Director has been negligent or has failed to discharge his responsibility and allegation that he has connived or has been complicit in approving financial statements, which he knows to be false or conceal material information. While the latter may constitute an offence under Section 448,the former does not.

- hence, reasoning of learned trial court is clearly unsustainable and unsupported by documents put forth.

- therefore, the impugned summons and the impugned order concerned with such summon to a limited extent as concerned is set aside.

1.13

ISSUE:Whether as inadvertent ‘typographical error’ in the extract of ‘Minutes’, characterizing the ‘special resolution’ as

‘unanimous ordinary resolution’ will render a resolution passed as ‘special resolution’ as invalid?

- appellant is a closely held pvt. co. incorporated on 8/8/12.authorized share cap=90 Lakhs out of which 30 Lakhs=issued,subscribed and paid-up cap.

- it had filed a petition confirming cap reduction under Section 66.

- the fundamental plea being the NCLT failed to appreciate an "inadvertent typographical error" in the minutes extract characterizing a "special resolution" as "unanimous ordinary resolution".

- further co. has fulfilled all compliances and impugned order liable to be set aside.

- Appellant has also submitted that only due to a ‘typographical error’ in the extract of ‘Minutes’, a resolution passed unanimously by the shareholders will not ceased to be a ‘special resolution’.

- NCLAT observed that reduction is a domestic affair and tribunal shall not intervene as the majority would prevail.

- as the appellant admitted the typographical error and as the resolution has been filed with the ROC, NCLAT allowed the appeal, thereby confirming reduction of appellant.

1.15

1.17 (same as 1.7)

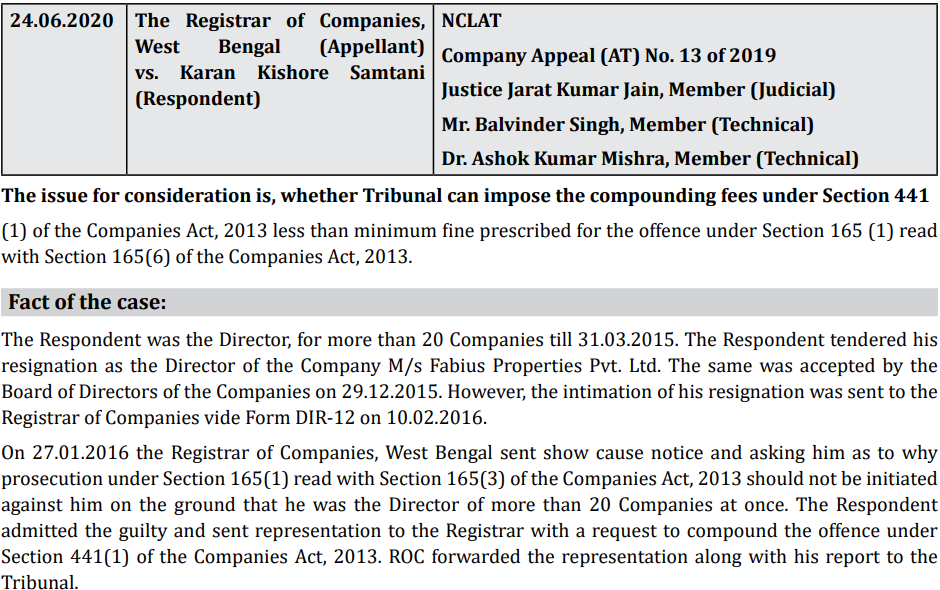

1.18

- NCLAT observed the violation of Section 165(1) by respondents from 01/04/'15 to 28/12/'15 which is punishable and was wrongfully imposed a less than minimum fee by NCLT, Kolkata bench.

- Taking into consideration, the facts and circumstances of the case, NCLAT imposed minimum fine at the rate of 5000 rupees for every day for the period 01.04.2015 to 21.02.2016 i.e. 272 days. The NCLAT quantified the penalty amount to Rs. 13,60,000/-. The Respondent has already paid Rs. 50,000/- after adjustment, now he is liable to pay Rs. 13,10,000/-. Therefore, the Respondent is directed to pay such amount within a period of 60 days in NCLT, Kolkata.

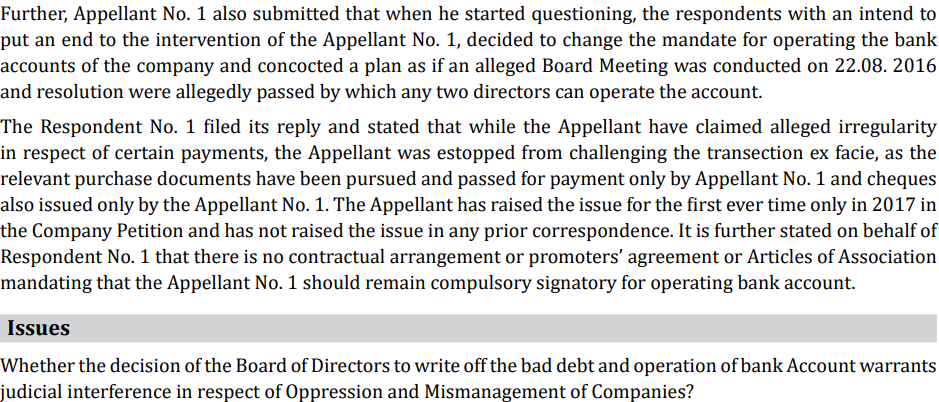

1.19

- NCLAT observed that appellant's records of attendance and signs on entry register shows of his presence where meeting was conducted.

- at the very same meeting, majority passed a resolution that was inside the domain of board and wasn't oppressive.

- NCLT has put its reliance on Judgement of NCLAT in Upper India Steel Manufacturing and Engineering Co. Ltd. & Ors. Vs. Gurlal Singh Grewal & Ors. where it was held that cheque signing power is solely a business decision and cannot be interfered. Further after the authority to sign the cheques has been revised we do not have any fact whether after the revision of the authority the appellant has been totally excluded or not from the operation of the account. In case a person is excluded positively not to have signed even a single cheque after the revision this could be colour-able exercise. No evidence has been brought forth to make the change in authorization to operate the bank account as a colour-able exercise. Therefore, this contention has no weight.

- NCLAT upheld NCLT,Chennai's decision that it is a commercial decision not warranting judicial interference.

- oppression & mismanagement acts must be harsh and wrongful and not based off on an isolated incident on majority's part is essential to be proved.

1.20

- respondent also submitted every intention of redeeming pref. shares @ improvement in the financial situation.

- dividend was paid to equity and pref. both as per terms.

- business had drastically gone down due to uncertain cash position and non-realization of realizables from Middle East.

- NCLAT examined the legislature's intention in Section 55&245 which state if a co. can't redeem it's pref., then it MAY issue further redeemable pref. in lieu of the former shares WITH consent of 3/4th of such pref. shareholders and the tribunal's approval.

- however, the proviso states that Tribunal shall order redemption for non-consenting shareholders.

- requisite approval of tribunal and shareholders is a necessity but is silent on any kind of actions taken by concerned shareholders before petition filing @Tribunal.

- thus, remedies are COMPULSORY Tribunal approval/consent or dissent.

- however, pref. shareholders encompassed within Section 2(55) read with Section 88 may file a petition under Section 245 as a class action suit.

- hence, findings of the NCLT that the Appellant being preference shareholders has no locus standi to file application for redemption of preference shares does not hold good. Thus, NCLT, Chennai Bench impugned order was set aside. The matter is remitted back to NCLT, Chennai Bench to decide.

1.22

- by an order dated 11/01/2019 NCLT,Ahmadabad ordered dispensation of shareholders and creditors meeting.

- notices directed to be issued to regional director(RD,north western region),ROC,concerned IT authorities,SEBI,BSE ltd;NSE ltd for representations within 30 days from notice receipt.

- publications in vernacular language and English paper along with statutory notices issued.

- NCLT after considering the reports of chair-people of separate meetings directed the RD and the IT authority to file representation under Section 230(5).

- Joint Commissioner of Income Tax (OSD), Circle (3)(3)-1, Mumbai and the income Tax Officer, Ward 3(3)-1, Mumbai have preferred these appeals.

- According to the Appellants, the Tribunal has not adjudicated upon the objections raised by the Appellant-Income Tax Department at the threshold before granting any sanction to the proposed composite scheme of arrangement.

- submitted that the Tribunal has not dealt with specific objection that conversion of preference shares by cancelling them and converting them into loan, it would substantially reduce the profitability of Demerged Company/ ‘Reliance Jio Infocomm Limited’ which would act as a tool to avoid and evade taxes.

- NCLAT held that without going to record and without placing evidence or appearing before tribunal,IT authorities' allegations didn't hold true.

- the mere fact that a scheme might result in reduction in tax due doesn't form a basis to challenge the validity of the scheme.

- NCLT has granted liberty,just as sought,for the IT authority to inquire into the scheme and take apt steps,if required.

- NCLAT while upholding the decision of NCLT of granting such liberty decided not to interfere with the scheme and dismiss appeals.

1.23

- NCLAT set aside NCLT,Chennai's order to extent of waival of additional fee and held that NCLT had no power to do so.

- ROC,Kerala is directed to charge a minimum fee and respondent directed all pending returns with requisite fee within 30 days from order receipt to ROC,Kerala.

1.24

- the respondent/transferor LLP with transferee co. and their respective members moved a joint petition under Section 230-232 with NCLT,rules 2016.

- Transferor LLP is incorporated on 4.1.2016 under the provisions of Limited Liability Partnership Act, 2008 having its registered office in Chennai. The transferee company is a private limited company incorporated on 12.1.2017 under the Companies Act, 2013 and having its registered office also in Chennai.

- both bodies engaged in establishing and/or acquiring A&V laboratories for film,TV and radio productions etc.

- NCLAT observed that these respective bodies were governed by their respective bodies and not by the 1956 act. hence, as per Section 230-232 in 2013 act a company or companies can be merged or amalgamated into another company or companies. The Companies Act, 2013 has taken care of merger of LLP into company. In this regard Section 366 of the Companies Act, 2013 provides that for the purpose of Part I of Chapter XXI the word company includes any partnership firm, limited liability partnership, cooperative society, society or any other business entity which can apply for registration under this part.

- under here LLP shall be treated as co. and can apply for registration and subsequently merged.

- NCLAT further observed that the provisions of the Companies Act, 2013 as a whole in reference of conversion of Indian LLP into Indian company there is no ambiguity or absurdity or anomalous results which could not have been intended by the legislature. The principal of casus omissus cannot be supplied by the Court except in the case of clear necessity and when reason for it is found in the four corners of the statute itself. There is no such occasion to apply the principal of casus omissus.

- thus,no question of infringement f constitutional right arises.

- The NCLAT held that the impugned order passed by NCLT, Chennai Bench is not sustainable in law and thus, set aside, which is allowing the merger of an Indian LLP with an Indian company without such registration. Cassus Ommisus: a situation omitted from or not provided for by statute or regulation and therefore governed by the common law.

1.25

- the proviso to Section 167(1)(a) under challenge states that a director of defaulting co. doesn't vacate post in defaulting co. but vacates all other directorships.

- petitioner contends that this leads to unfair treatment based on multiple directorships.

- madras high court held that proviso to Section 167(1)(a) must be interpreted in ordinary terms and would apply to the entirety of Section 164 including sub-section 2. The Court has further held that this proviso can be justified on two grounds.

- first, exclusion from vacation in defaulting co. done to prevent perpetual vacancy from 167(1)(a) to all newly appointed directors.

- second,underlying object in in the interest of transparency and governance.

- Owing to these justifications, the Court thus holds that the proviso to Section 167(1)(a) is neither manifestly arbitrary nor does it offend any of the fundamental rights guaranteed under Part III of the Constitution of India. Thus, the writ petition is dismissed.

1.26

- It was held that the provisions of Section 164 (2) would apply prospectively and that it a well settled law, that no statute should be construed to apply retrospectively, unless such construction appears clear from the language of the enactment or otherwise necessary by implication. It was also equally trite that a statute is not retrospective merely because it affects existing rights or because a part of the requisites for its action is drawn from a time antecedent to its passing.

1.27

- appellant is an unsecured cr. of gujarat NRE coke ltd. and preferred appeal under Section 421.

- this appeal is against order by NCLT,Kolkata allowing application under Section 230-232.

- NCLAT observed that during liquidation,steps are taken for reviving and protection from management. so,During a Liquidation proceeding under Insolvency and Bankruptcy Code, 2016, a petition under Section 230 to 232 of the Companies Act, 2013 is maintainable.

- even during liquidation,protection from management making promoters ineligible to file application for a scheme under Section 29A of IBC,2016.

- further, Section 35(f) of same prohibits liquidator to sell assets to an ineligible person.

- NCLT by impugned order 15/05/2018 failed to notice the application was not maintainable at the instance of promoter/respondent.

- The NCLAT thus, set aside the order passed by the NCLT, Kolkata bench and remitted the case to Liquidator/ Adjudicating Authority to proceed. Hence, the Appeal is allowed.

1.28

- NCLAT observed that appellant was granted huge relief before and no further extension could not be justified.

- if the co. had been repaying principal and interests according to Sections 72,73&76 of the 1956 act, then Section 74(1)(b) of 2013 act deemed complied subjective to respective T&C.

- when 74(1)(b) have been attracted and defaulted therein, penal provisions shall be applied per the earlier scheme.

- HENCE, PRESENT APPEAL FOR FURTHER EXTENSION IS DISMISSED.

1.29

- only 3 shareholders in OBO india including OBO germany and 2 appellants.

- under Section 241,petition maintainable if 1/10th or more of total members had filed an application.

- appellants were eligible.

- argument that appellants ceased to be members and therefore petition was not maintainable was REJECTED as it would be attracted only when appellant shares had been wrongfully acquired.

- in present case, there was a gradual change in shareholding per different agreements.

- However, Section 236 could be invoked only in case of amalgamation, share exchange and conversion of securities and for any other reasons. It was observed that the words “for any other reasons” had to be read ‘ejusdem generis’ with the preceding word and must take the same or similar colour.

- legislature could have generally mentioned that 90% of issued equity could intend to buyout the remaining stake.

- Thus, it was held that the respondents could not have invoked Section 236 to acquire the minority shares of the Appellants as the said provision wasn’t applicable to their case. Hence, the appeal was allowed.

- ROC conducted an inquiry under Section 206 and prima facie concluded:

- mismanagement

- compromise in corporate governance and risk management by

- indiscriminately increasing borrowings through PFIs

- appeal filed by Infrastructure Leasings and Financial Services Ltd. (IL&FS) against order dated 31/01/19 passed by NCLAT.

- impugned order dismissed appellant's appeal and confirmed NCLT,Mumbai's order dated 01/01/19 allowing Central Govt.'s application under Section 130.

- Supreme Court observed that NCLT may pass such orders under Section 130 if

- relevant earlier accounts prepared fraudulently

- affairs mismanaged casting doubt on statements

- according to SFIO & ICAI reports, it can't be said that above conditions aren't satisfied.

- based on facts and circumstances and based on public interest,NCLT is justified and therefore it's order is upheld dismissing IL&FS's appeal,concurring with NCLAT.

1.31

- NCLAT observed respondent was functioning as MD since 1996 and wasn't appointed for fixed tenure.

- upon removal,MD is entitled to compensation for loss of office per Section 202.

- appellant's argument of "loss of confidence" doesn't appear to be on the act and accordingly NCLT,Chennai awarded compensation plus 10% interest from removal to payment.

- Hence, appeal is accordingly dismissed.

1.32

- NCLAT held that as the lender State Bank of India has a nominee as one of the Director of the Company and the petitioner have alleged mismanagement of the company, The NCLT rightly allowed the State Bank of India to intervene in the matter. The appeal is accordingly dismissed.

1.33

- NCLAT held no doubt that ROC file affidavit attaching notice copy dated 21/03/17 per STK-1 and its issuance.

- other than that,appeal under NCLT stated that notice under Section 248 published under official gazette.

- copy of notice STK 5 also gave opportunity to the appellant to move the ROC if it was aggrieved by the proposed removal.

- appellant made no such effort. thus, "no opportunity given" contention is unacceptable.

- according to invoices, seller=kanodia hosiery mills and buyer=kanodia knit ltd. and both have same address.

- thus,appellant's claim on these documents of bring in business/operating doesn't hold true.

- hence, appeal is rejected.

1.34

- Reliance was placed on the judgment in Ammonia Supplies Corporation (P) Ltd. vs. Modern Plastic Containers Pvt. Ltd. and Others to canvass the proposition that while examining the scope of Section 155 of the Companies Act, 1956 (the predecessor to Section 111), a view was taken that the power was fairly wide, but in case of a serious dispute as to title, the matter could be relegated to a civil suit.

- subsequent legal developments had direct effect on present case as it provides rectification powers under Section 59.

- also under Section 430, civil suit jurisdiction is totally barred as against NCLT.

- In light of the above facts, the Supreme Court was of the view that relegating the parties to a civil suit would not be appropriate, considering the manner in which Section 430 was widely worded.

- Hence, the appeal was allowed and it was held that the appropriate course of action would be to relegate the appellants to remedy before the NCLT under the Companies Act, 2013.

1.35

- In ‘Cyrus Investment Pvt. Ltd. & Anr. V.Tata Sons Ltd. & Ors., NCLAT has noticed the shareholding pattern and taking into consideration the fact that majority of the shareholders having less than 10% of the shareholding, except 2 got more than 10% and that the Appellant ‘Cyrus Investment Pvt. Ltd.’ has invested about Rs.1,00,000 Crore in ‘Tata Sons Ltd.’ out of the total investment of Rs.6,00,000 Crore.

- present case isn't only different but a reversal where majority have 10%<.

- therefore,respondent & tribunal have not made an exceptional case worthy of a waiver.

- factors recorded by NCLT of the impugned order are no grounds to treat them as exceptional circumstances keeping in view our Judgment in the matter of ‘Cyrus Investment Pvt. Ltd. & Anr. v. Tata Sons Ltd. & Ors.’ (Supra).

- considering above points,tribunal's impugned order based on misconceptions is set aside.

- the petition preferred by 1st resp. in respect of 2nd resp. is not maintainable and hereby dismissed.

- appeal allowed with aforesaid.

1.36

- NCLAT held that respondents rightly submitted that appellants had knowledge regarding scheme and had given an NOC.

- appellant's argument seems unconvincing having different capacity as 100% shareholder of transferor and thus, notice should've been given.

- although argued that share purchase agreement being prospective, auditors may not have been made privy.

- from the certified copy of record of proceedings before NCLT, Chennai filed with Diary No.4167 that the Official Liquidator in his Report noted that the CA did record that there was change in management in the month of August, 2016 in respect of transferor Company No.1. The Report of Official Liquidator shows that both the transferor Companies were wholly owned subsidiaries of transferee Company.

- after appellants executed the SPA,they surrendered shares and admitted as being resigned as directors on 01/01/17.

- therefore,NCLAT believes appellants had no difficulty initially but as SPA transaction landed in difficult ground, they raised grievances on being provided notice.

- NCLAT did not find that there is any substance in the grievance raised by the Appellants. Dispute relating to SPA is before Arbitration and Transferee Company is facing it. If Appellants had difficulty, they never went before NCLT to raise Objections although they knew about the amalgamation process going on. This being so, both the Appeals are rejected.

1.37

- before analysing the court's jurisdiction, we take a look at the scheme along with NCLT powers under Companies act,2013.

- said powers of the NCLT include powers as broad as “regulation of conduct of affairs of the company” under Section 242(2) (a), as also various other specific powers. NCLT is a tribunal which has been constituted to have exclusive jurisdiction in the conduct of affairs of a company and its powers can be contrasted with that of the CLB under the unamended Companies Act, 1956.

- Section 420 of 2013 act as vested powers such as passing orders as it think fit plus the review powers along with punishment for contempt.

- under Section 62 a procedure has been prescribed including sending an offer letter to existing shareholders & employees including all respective terms leading to increased subscribed share cap.

- effect of increase has an automatic effect of alteration in members register under Section 59.

- Any dispute in respect of rectification of the register of members under Section 59 of the Companies Act, 2013, can be raised by any person aggrieved to the Tribunal i.e., the NCLT.

- The bar contained in Section 430 of the Companies Act, 2013 is in respect of entertaining “any suit”, or “any proceedings” which the NCLT is “empowered to determine”. The NCLT in the present case would be empowered to determine that the allotment of shares in favour of the Defendant Nos.5 to 9 was not done in accordance with the procedure prescribed under Section 62 of the Companies Act, 2013.

- NCLT also empowered whether rectification required in register/voting rights of several defendants/injunction order protecting assets of defendant no.1/oversee and supervise such workings by appointing such persons as it deems necessary.

- non-compliance of section 62 also constitutes mismanagement. jurisdiction to go into these allegations, vests with NCLT under Section 242.

- NCLT powers more broad and more than a civil court.

- Even if in the present case, the Court grants the reliefs sought for by the Plaintiff, after a full trial, the effective orders in respect of regulating the company, and administering the affairs of the company, cannot be passed in these proceedings. Such orders can only be passed by the NCLT, which has the exclusive jurisdiction to deal with the affairs of the company.

- The Legislative scheme having been changed, with the amendments which have brought about and for all the reasons stated herein above, this Court holds that the present suit is liable to be rejected leaving the Plaintiff to avail its remedies, in accordance with law before the NCLT.

1.38

1.39

- calcutta high court held that petitioner is neither co;member nor creditor and not named under Section 560 in 1956 act. he doesn't have statutory right to apply but there is a remedy for every violation.

- can't be said that petitioner can't ventilate grievances/seek redressal anywhere.

- The constitutional right to approach a Court Article 226 of the Constitution of India, cannot be taken away by statute. Such a person can approach a regular Civil Court or apply under Article 226 of the Constitution of India for redressal of his grievances in respect of a decision of the Registrar of Companies striking off the name of a company.

- apparently respondents 2&3 were acting under an exit scheme under Section 560 which allows the ROC to strike a defunct co. after having a reasonable cause and issuing a show cause notice.

- even under an exit policy,the ROC & respondents have to prove that company is eligible to be struck off on the basis of respondent's claim of the co. being inoperative.

- The NCLAT observed that a company having a paid up capital of Rs.50,00,000/-, inventories of Rs.50,51,500/- , holding shares worth Rs.13,84,61,540/- and entering into tripartite agreement to carry on hotel business cannot be said to be without business or being inoperative since incorporation. The decision of the RoC impugned herein dated September 10, 2015 is, perverse.

- Therefore, the Registrar of Companies, West Bengal shall forthwith restore the name of Rama Inn (International) Private Limited in the Register of Companies and shall take all consequential follow up steps to give effect to such restoration.

No comments:

Post a Comment