Compliance Process includes: compliance program,compliance audit,compliance reporting etc. to avoid non-compliances and to effect controls.

it includes research & analysis+investigation to determine potential issues and getting a realistic view for a positive image as well as customer trust.

COMPLIANCE MANAGEMENT FRAMEWORK

- identification: under various legislations applicable consulting with functional heads

- ownership: described function/individual wise along with primary/secondary

- awareness: meetings/trainings or with manuals containing compliance details

- reporting: status communicated annually to concerned by compliance officer for appropriate corrective action

- reported periodically in MIS

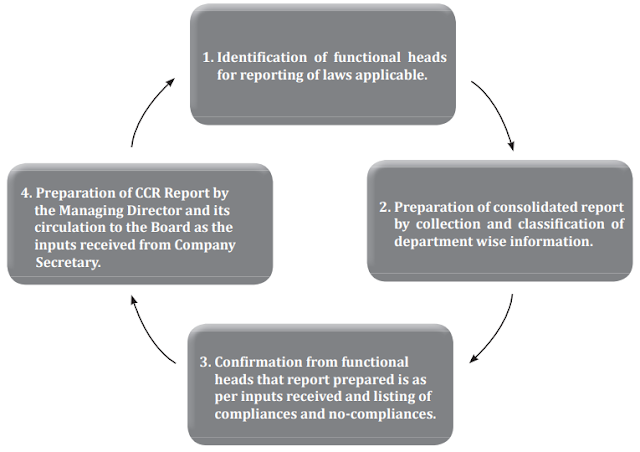

PROCESS OF CORPORATE COMPLIANCE REPORTING

co. act,2013 provided specific exemptions through notifications/amendments

UNDER CO. ACT, 2013

- PVT. CO.

- (184) & rule 9 of co. (Board meetings and powers) rules,2014

- director discloses interest= MBP-1

- at first meeting in every FY or subsequent to each modification

- kept at Regstd. office upto 8 years from FY end concerned

- (164[2]) & rule 14[1] co. (director appointment/qualification) rules,2014

- director disqualification= DIR-8

- before appointment/re-appointment

- (92[1,4]) & rule 11[1] of co. (mgmt. and administration) rules,2014

- annual return= MGT-7

- within 60 days of AGM

- (92[3]) & 134[3][a] & rule 12[1] placing on website

- (137) & rule 12[1] co. (accounts) 2014

- financial statements= AOC-4/(CFS)

- within 30 days of AGM

- (92[2]) & rule 11[2] co. (mgmt. and administration)

- MGT-8

- listed co's annual return certified by PCS

- or a co. with PUC=10 cr./more OR turnover=50 cr./more

- (134) & rule 8 co. (accounts)

- board's report

- attached with statements and signed by "chair or 2 directors, one of whom is MD/CEO/CFO/CS, if appointed

- (136) circulation of financial docs and other relevant docs

- at least 21 clear days before the AGM

- (101) & rule 18 co. (mgmt. and admin.); SS-2

- AGM NOTICE

- sent to all directors,members,auditors,legal representatives of any deceased member and insolvent's assignee

- (173[3]) & SS-1

- board meeting notice

- not less than 7 days in writing

- less than 7 days with respect of presence/ratification of independent directors

- (139[1]) & rule 4[2] co. (audit and auditors)

- auditor appointment= E-ADT-1

- notice within 15 days of appointment meeting

- specified IFSC pvt may file within 30 days

- (203) & rule 8A co. (appointment/remuneration)

- CS appointment

- every listed and pvt. having PUC=10cr./more

- (88) & rule 3 co. (mgmt. and admin.)

- MGT-1/2

- registers of members/debentureholders/other securityholders

- SMALL CO. -- 1,2,3,4,6,7,8,9,10 & 12 same as pvt. co.

- OPC -- 1,2,3,4,6,9(unless an only director) & 10 + no need to prepare a cash flow statement & exempt form auditors' rotation

LLP COMPLIANCES UNDER LLP ACT,2008

- change in partnership shall not affect existence,rights or liabilities

- partnership agreement

- registrar of co. manages LLPs

- one partner must be Indian

- (33) partner contri per subscription sheet

- in case of excess contri

- COMPLIANCE REQUIREMENT UNDER ACT/RULES

- (32) & rule [23(1)]:contribution accounted for/disclosed in accounts

- [23(2)]: contri. brought by agreement/contract of services valued by practising CA

- (34): maintain accounts @ RO for 8 years

- rule [24(2)]: containing finances,assets & liabilities,statement of goods purchased

- [24(3)]: 8 yrs.

- (34[3]) and rule [24(4)]: file statement of account and solvency {signed y designated partners} in Form 8 within 30 days from 6 months of FY end.

- (34[4]) and rule [24(8)]: audit for TURNOVER>40 lakhs OR CONTRI.>25 lakhs

- rule [34(4)]: foreign LLP statement of accounts

- (35): annual return within 60 from FY end in Form 11

- rule [25(2)]: additional certificates when Turnover<5 crore or CONTRIBUTION<50 lakhs; Otherwise a certificate from PCS

- rule [27]: document preservation

EXEMPTIONS OF SECTION 8 CO.

- (2[24): appoint qualified CS

- (2[68,71]): minimum paid-up share cap inapplicable

- (96[2]): AGM not on national holiday

- (101/136[1]): "21 days" to "14 days"

- (118): minutes circulations except if mentioned in AoA

- (149,150,152[5],165[1],178)

- (160): except where AoA provides director election by ballot

- (173[1]): At least 1 board meeting within 6 calendar months

- (177[2]): no independent directors necessary

- (184[2],189): if exceeds 1 lakh

- (186[7]): inapplicable if 26%/more held by govt.

- SEBI (LODR) COMPLIANCE: refer Ch-2 of ICSI study material

.png)

No comments:

Post a Comment