this need to boost value may be felt necessary due to competition,adverse economic climate or moving towards a new direction.

it as an INORGANIC GROWTH STRATEGY as against when company expands on it's own based on profit & revenue.

M&A(mergers and acquisitions) was first attempted in 1988 in India with an ineffective unfriendly takeover bid by Swaraj Paul to overpower DCM ltd. and Escorts ltd. but after the industrial policy of 1991, the best way to globalize and compete was by restructuring.

NEED AND SCOPE FOR CORPORATE RESTRUCTURING

- enhancing shareholder value

- deploying surplus from one business to finance growth in another

- inter-dependence upon businesses

- core competencies

- tax advantages

- improve performances

- core focus to gain synergies,minimize operating costs,maximize efficiency

- minimization of business risk by diversification

- exploiting strategic assets

- FINANCIAL-

- refers to capital base and raising finance and bouncing back from financial distress without going into liquidation.

- poor financial performance

- external competition

- erosion/loss of market share

- emerging market opportunities

- also involves equity/debt restructuring

- MARKET/TECHNOLOGICAL-

- Product market segments

- new technology

- tends to lead new training initiatives along with layoffs

- involves alliance with third parties for knowledge/resources.

- Joint Ventures,Strategic Alliances,Franchising

- ORGANISATIONAL-

- establishing internal structure

- improving personnel capability

- creating/downsizing department as needed

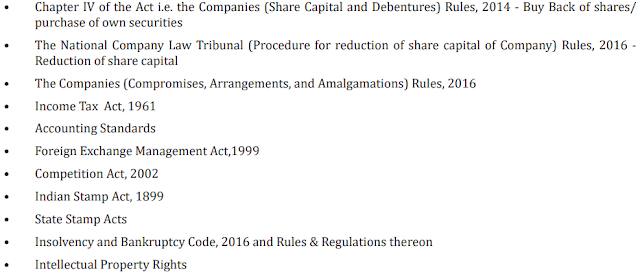

LEGAL FRAMEWORK

CHAPTER XV OF COMPANIES ACT,2013 AND COMPANIES (COMPROMISES,ARRANGEMENTS AND AMALGAMATIONS) RULES,2016

REASONS FOR GOING THROUGH AN M&A

- synergy in the form of revenue enhancement and cost savings

- expansion

- preemption of competition

- domination in respective sectors and markets

- tax benefits

- economies of scale

- acquiring new technology

- improved market research and industry visibility

DIFFERENT TRANSACTIONS INVOLVED UNDER M&A

- MERGERS

- merger is the fusion of 2/more companies resulting in loss of identity of a single company.

- legal consolidation by amalgamation or absorption or formation of new co.

- after board's approval for merger,acquire company ceases to exist

- for ex:Vodafone-Idea,SBI with it's subsidiary banks,etc.

- Types:

- horizontal merger

- b/w co. selling same products in same market/direct competition

- benefits from economies of scale,reduce competition,monopoly,market control.

- example-Facebook's acquisition of Instagram

- vertical merger

- b/w co. in same industries but at different production stages

- example-merger of a producer and supplier

- conglomerate merger

- merger b/w co. having no common business area

- main objective-expansion

- example-a watch manufacturer acquires a cement manufacturer, a steel manufacturer acquires a software manufacturer

- con-generic merger

- merger b/w 2 related co.

- example-combo of computer system manufacturer with a UPS manufacturer.

- reverse merger

- pvt. co. becomes public by acquiring it as an investment instead of going through the process of conversion.

- where a weaker/smaller co. acquires a bigger co. OR where parent merges into subsidiary OR loss-making acquires a profit-making.

- example-

- ICICI merged with ICICI bank in 2002

- Merging of Oil exploration company Cairn India with parent Vedanta India

- Merging of Godrej Soaps, profitable and with a turnover of `437 crore with loss-making Gujarat Godrej Innovative Chemicals with a turnover of `60 crore, the resulting firm was named Godrej Soaps.

- ACQUISITION:one entity takes ownership of another's stock/controlling interest on share capital.

- while merger and acquisition may be used interchangeably they seem to have a difference. nonetheless,contemporary transactions are referred to as M&A.

- AMALGAMATIONS

- combo/absorption/blending of two/more companies to form another.

- making an arrangement thereby uniting the undertakings of the companies so as to becomes vested in,under control of another.

- CONSOLIDATION:new co. created, and shareholders receive common equities of new firm

- TENDER OFFER:co. offers shareholders directly to purchase outstanding shock at a specific price.

- ASSET ACQUISITION:typical during bankruptcy proceedings

- MANAGEMENT BUYOUT

- management purchases operations that they manage

- owners rather than employees

- preferred as vendors nervous to approach buyers and disclosing sensitive info

- PURCHASE AS A RESOLUTION UNDER IBC LAW by participating in the bid process by submitting most effective resolution plan

CASE STUDY-VODAFONE INDIA AND IDEA CELLULAR/FLIPKART AND eBAY

DEMERGER

- single business broken into components either to operate on own,be sold or to be dissolved.

- related contracts transferred to resulting co. unless other specific restrictions mentioned

- TYPES OF DEMERGERS

- Divestiture

- selling/disposing assets for cash/cash and debt and not against equity

- Spin Offs

- shares of new independent entity distributed to parent co. shareholders on pro-rata basis OR the parent holds the equity of new co. itself.

- focus on resources and better management of potential business

- due to a different direction or different strategic priorities OR if co. fails to find an acquirer.

- created by distributing full ownership as stock dividend to existing shareholders.

- Splits/Divisions

- maximize profitability by removing stagnant units

- proportioned pro-rata share not mandated, rather an OPTION to exchange shares.

- SPLIT-UPS:all capital stock/assets exchanged for 2/more newly established co. resulting in parent's liquidation

- SPLIT-OFFS:capital stock of division/subsidiary/affiliate co.transferred to stakeholders in exchange of part of parent's stock

- Equity Carve-Outs

- subsidiary share percentage issued to public

SLUMP SALE

- undertaking transfer due to

- helps to improve performance

- helps strengthen financial positions

- eliminates negative synergy

- tax/regulatory advantage

- according to income tax 1961, constitutes of part/unit/division/business activity but doesn't include individual assets/liabilities.

- CASE LAW- CIT v R.R. RAMKRISHNA PILLAI (66 ITR 725)

JOINT VENTURE

- business/contractual agreement to pool resources such as knowledge,human capital,technology,access to market for a specific task.

- for ex-when one company that owns resources contracts with another company to use those resources for manufacturing a new product; VISTARA AIRLINES; TATA STARBUCKS

- TYPES

- Equity-Based

- Non-Equity Based

STRATEGIC ALLIANCE

- arrangement between companies deciding to share resources to undertake specific,mutually beneficial project.

- alliances with suppliers,producers and other stakeholders to do much of the production for them.

- for ex- NIKE;BOEING CO.;ETIHAD AIRWAYS;ICICI BANK & VODAFONE IDEA

FINANCIAL RESTRUCTURING

- debt restructuring

- reduction and/or extension of payment terms/change in T&C

- improving liquidity/increasing cash flows

- best method:debt-equity swap

- equity restructuring

- reduced liabilities/increased firm value

- restructuring capital base and raising finance

- TYPES

- Share Capital Alteration/Reduction:As per Company Law/SEBI guidelines and related acts.

- Share Buy-Back

- case study:Gammon Ltd.

No comments:

Post a Comment